The end of Zionist Israel looms — a Day of Atonement is coming like no other before it.

Rabbi’s arrest signals Israel ‘no longer for all Jews’ — US Conservative leader

40 Jewish Groups Oppose Equating Anti-Semitism with Criticism of (Zionist) Israel

The end of Zionist Israel looms — a Day of Atonement is coming like no other before it.

Rabbi’s arrest signals Israel ‘no longer for all Jews’ — US Conservative leader

40 Jewish Groups Oppose Equating Anti-Semitism with Criticism of (Zionist) Israel

MARTIN ARMSTRONG: The entire story in the Western Press has painted Trump as being some sort of puppet of Putin. The latest story is how the press is touting that Trump, Jr. said that the Magnitsky Act would be reconsidered if his father won. This story is plastered all over the press as in Newsweek and others like the Washington Examiner. All of these stories are based upon the entire premise that the Magnitsky Act is somehow a justified law and that Magnitsky was a whistleblower who was killed in Russia. There is another documentary which has been banned in the United States and all the journalists eager to overthrow Trump simply refuse to watch or even investigate objectively.

MARTIN ARMSTRONG: The entire story in the Western Press has painted Trump as being some sort of puppet of Putin. The latest story is how the press is touting that Trump, Jr. said that the Magnitsky Act would be reconsidered if his father won. This story is plastered all over the press as in Newsweek and others like the Washington Examiner. All of these stories are based upon the entire premise that the Magnitsky Act is somehow a justified law and that Magnitsky was a whistleblower who was killed in Russia. There is another documentary which has been banned in the United States and all the journalists eager to overthrow Trump simply refuse to watch or even investigate objectively.

Armstrong Post Another Banned Documentary Hidden from Americans

When Bolkovac exposed this type of stuff, she was instantly demoted, threatened, fired, and forced to flee the country. She was a target because she had access to and kept the incriminating documents. She was the inspiration behind the Hollywood feature film, “The Whistleblower: Sex Trafficking, Military Contractors, and One Woman’s fight for Justice”

Her role, while she had her job, involved a post with the International Police Task Force arranged by DynCorp Aerospace. She won a lawsuit against them publicly exposing their numerous human rights violations. Anytime I write about DynCorp, I have to mention that retired army General James Grazioplene, who worked in the Pentagon and as the Vice President of DynCorp, is currently facing multiple rape charges.

Zionist Israel just committed suicide.

Israel adopts divisive law that declares only Jews have the right of self-determination

Although the law is largely symbolic, critics say the legislation is racist in origin and verges on apartheid.

Phi Beta Iota: Zionist Israel (not to be confused with Judaism or Jews of faith loyal to their individual nation-states) is self-destructing. This is STRIKE 18.

See Also:

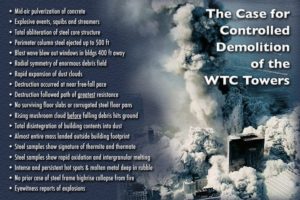

It is now known that Rudy Gulliani and the leadership of NYC as well as the owners of WTC knew years before 9/11 that the buildings must be brought down before 2007 because the interior steel and exterior aluminum were both compromised and the buildings would be at risk of collapsing — the cost to dismantle them was estimated to be $2B, inclusive of asbestos remediation. Hence the choice was clear: spend $2B to take care of the problem; or fake a terrorist incident and in collaboration with a complicit insurance company, take $7B in a false claim. The FBI — or Mossad officers pretending to be FBI — appears to have played a major role in the intimidation of all the architects, engineers, and photographers who spent years investigating the vulnerability of the buildings to uncontrolled collapse. None of this was investigated by the 9/11 Commission.

It is now known that Rudy Gulliani and the leadership of NYC as well as the owners of WTC knew years before 9/11 that the buildings must be brought down before 2007 because the interior steel and exterior aluminum were both compromised and the buildings would be at risk of collapsing — the cost to dismantle them was estimated to be $2B, inclusive of asbestos remediation. Hence the choice was clear: spend $2B to take care of the problem; or fake a terrorist incident and in collaboration with a complicit insurance company, take $7B in a false claim. The FBI — or Mossad officers pretending to be FBI — appears to have played a major role in the intimidation of all the architects, engineers, and photographers who spent years investigating the vulnerability of the buildings to uncontrolled collapse. None of this was investigated by the 9/11 Commission.

Alert Reader says:

This was the technology being released and in current use in 1992 timeframe. What is now used is incredibly advanced and best described as remote induction (soft-style) no voices heard but attitudes shaped in mass population very slowly and subtly except for controlled experiments like the DNC demonstrations of college students who leaders are paid and the followers are targeted with mass (soft) remote induction. Remote soft induction is now the norm, but voice to skull is periodically tested and deployed to see how effective it capabilities can be in selected unstable or mentally ill targets.

Phone calls can be totally or partially simulated in the alleged speaker's true voice or single words changed to sound exactly the same as the speaker, all done by high speed quantum based A.I. logarithms. There is a lot more to all this now, depends on how much you want to know. This jives with the Comm 12 Briefing Report and the Finders docs referred to in the US News and World Report (USN controlled).

Two documents below the fold.