Seeds of Destruction: Why the Path to Economic Ruin Runs Through Washington, and How to Reclaim American Prosperity

by Glenn Hubbard and Peter Navarro

FT Press, 266 pp., $26.99

Capitalism 4.0: The Birth of a New Economy in the Aftermath of Crisis

by Anatole Kaletsky

PublicAffairs, 396 pp., $28.95

Aftershock: The Next Economy and America’s Future

by Robert B. Reich

Knopf, 174 pp., $25.00

EXTRACT:

What is rarely recognized is that even if the US can emerge from a weak economy within a few years, the economic foundation that existed before the cataclysm of 2007 and 2008 may not be adequate to restore the widely shared prosperity the US needs. For more than three decades, economic growth had been largely dependent on rapidly rising levels of debt and on two major speculative bubbles, first in high technology and dot-com stocks in the late 1990s, then in housing in the 2000s. What will now replace them?

Income inequality widened sharply in these years and average wages stagnated for the many while record high fortunes were made by the few. The financial security and access to adequate health care and education for children that had defined the middle class since World War II have eroded rapidly. Meanwhile, investments in infrastructure such as transportation, as well as clean energy and education, have been badly neglected. All this raises doubts about America’s future economic vitality whether or not it balances its budget, and it does so at a time when international competition from Asia and the Southern Hemisphere will pose serious challenges during this century. How will Americans live a decade from now?

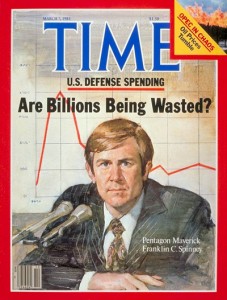

CHUCK SPINNEY: The budget/tax compromise just agreed to by President Obama and the Republicans blew a hole in the out-year deficits by continuing for two years the Bush 2001 tax cuts to the wealthy in the hope that a stimulative effect will trickle down to grow the economy before the 2012 election. That the economy grew sluggishly after 2001, that federal deficits exploded after 2001, that the economy continued to hemorrhage manufacturing jobs after 2001, that income inequality continued to increase after 2001, that middle class wages continued to stagnate after 2001, and that the first decade of the 21st Century ended in the worst economic crisis since the 1930s do not seem to affected the political calculus in 2010 to increase these tax cuts to 2012.

In addition, the compromise included a sweetener in the form of a reduction in the highly regressive Social Security withholding tax as a sop to the low and middle classes. This reduction may well increase consumer spending slightly and stimulate the economy somewhat in the short term, but a major drag on consumer spending is excessive consumer debt levels relative to income, and it is quite likely much of the new money will go to debt reduction as consumers continue to retrench. Moreover high levels of debt in the financial and non-financial private business sectors are also a drag on the economy because businesses are retiring debt and saving rather than loaning money and investing. So, the real economic effect of tax cuts is likely to be quite modest. But the more important effect may well be political, because the cut in Social Security withholding taxes also made the financing of the Social Security system much more vulnerable to ideological attacks over the long term.

To understand why this vulnerability has increased, recall how the highly regressive Social Security tax increases of the 1980s were sold to the people as being necessary to properly financ3 the the Social Security trust fund over the long term. This sales job told the people, in effect, that the trust fund was equivalent to a private retirement account and would invest in productive assets for the future. The earnings from these assets would fund part of the future benefits. But the investments of the cash generated by these taxes were made in interest bearing US treasury bonds. In theory, the Social Security tax increases generated huge surpluses in the trust fund during the medium term that, together with the interest earned, could then be drawn down over the long term as social security expenses rose. But government deficits or surpluses are calculated on a cash flow basis, and the huge increase in Social Security surpluses in the 1990s generated a huge cash inflow. This inflow constituted the overwhelming contribution to the budget surpluses in the Clinton's second term. That is because social security cash inflow was added to inflows from general taxes and then netted against all spending outflows in the so-called unified budget. Most economists will argue, correctly in my opinion, that the trust fund is an accounting fiction and social security is really a pay as you go system and thus the unified budget is the best way to depict federal budget surpluses and deficits (which are netted cash flows). But the netting effect converted the social security tax increases into a “pay-more-than-you-go” scam — for example, the netting effects offset a large part of Bush's out of control deficits, driven mostly by his tax cuts, his increases in the core defense budget, and his war spending.

So, despite the economic purity of the unified budget, cutting the regressive Social Security withholding tax makes that fictional trust fund balance look much more underfunded over the long term, and now surpluses in the trust fund are disappearing, the ideologues will forget about the pay-more-than-you-go skimming operation and argue that the program is going broke, in effect portraying it as an economic investment account.

But pure economics is a fiction … as the forgoing illustrates, the reality is that we live in a political economy — shaped as much by factional politics and ideologies as economics. The political result of cutting the Social Security withholding tax likely to be a compounding of the original cape job to increase the regressiveness of the tax system in the name of social security trust fund's “solvency” while the politician in the federal government siphoned the money out of the trust funds in order to continue tax cuts to the rich and the wasteful spending, including defense and war mongering etc. Readers can rest assured that the anti-social security ideologues will use this worsening balance in the trust fund as ammunition to cut back on social security expenditures over the long term. Moreover, when it becomes time to debate whether or not all these recent temporary tax changes should be rescinded, it is important to remember that the President and Congress will be faced with prospect of raising taxes in the middle of the 2012 election. Does anyone doubt the outcome of that debate?

The expedient of making social security more vulnerable to ideological attacks in the interests of cutting a political deal illustrates the state of intellectual flabbiness shaping economic policymaking today. Given our nation's economic problems, this is a prescription for long term trouble — which raises the question: how can our political economy recover a modicum of decency and prosperity?

The below referenced book review, written last November, before the tax deal, by my friend Jeff Madrick, a liberal economist in the best sense of the term, addresses the analyses and recommendations of three new books on the subject of how to repair the US economy. Taken together they are a good summary of the real nature of the economic crisis facing America, not mention the dismal prospects for a recovery, given the current state of political debate. It makes for important reading, in my opinion.