I asked my good friend Marshall Auerback, an investment advisor and lawyer by training and a senior fellow at the Roosevelt Institute, to evaluate Treasury Secretary Timothy Geithner’s claim that TARP has been a stunning success. Geithner made this claim in a 10 October op-ed in the Washington Post, entitled, “Treasury Secretary Timothy Geithner tackles five myths about TARP,” which is contained below as Attachment 2 beneath Auerback’s critique [Attachment 1]. To those of you who would sanitize these loose ends as a lingering “moral hazard,” I would urge you to think again.

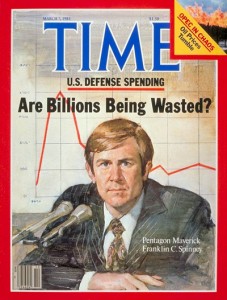

Chuck Spinney

Carloforte, Sardinia

——–[Attachment 1]——–

The Auerback Critque:Four Realities Debunk Geithner’s Five Myths

Marshall Auerback

We have left frauds in charge of failed banks and covered up their losses.

Congress, with the explicit encouragement of Federal Reserve Board Chairman Bernanke and the implicit acceptance of the Obama administration (especially Treasury Secretary Geithner), successfully extorted the Financial Accounting Standards Board (FASB) on behalf of the banking industry to force it to change the banking rules so that banks did not have to recognize losses on their bad assets until they sold them.

Gimmicking the accounting rules so bankers could lie about their asset values has caused the usual severe problems.

First, it allows the CEOs who control banks that are unprofitable to pretend that the banks are profitable and continue to pay themselves massive bonuses for destroying “their” banks. In addition to being unfair, this creates a criminogenic environment (to use the term of Professor Bill Black).

Second, it leads bank CEOs to cause their banks to hold onto bad assets (including bad home loans) at grossly inflated prices. This prevents markets from “clearing” and prolongs recessions. This is the Japanese scenario has led to the “lost decade” (which has now been extended).

Third, it makes it harder for regulators (should they choose to supervise vigorously) to do so because many regulatory powers are triggered by losses and the resultant failure to meet capital requirements [both of which are hidden by the accounting gimmickry].

Fourth, and perhaps most importantly, it embraces dishonesty as an official policy. Indeed, it is premised on the implicit claim that the solution to the accounting fraud that massively inflated asset valuations (and caused the financial crisis) is to change the accounting rules to encourage the massive inflation of those same asset values. Effective regulation is impossible without regulatory integrity. Lying about asset values destroys integrity.

More generally, nothing has been done to limit the parasitic nature of the financial system, which diverts capital and human talent from the real economy and transfers it to the financial sector where it makes financial elites exceptionally wealthy, provides them with decisive political power, encourages accounting control fraud, and harms the real economy.

Even in the case of the roughly 20 massive U.S. financial institutions considered “too big to fail” because the Bush and Obama administrations and their economists have claimed that if any of them were to fail they would cause a systemic global crisis, the public policy response has been perverse. The administrations’ terminology demonstrates the depths of the economists’ analytical errors and identification with the CEOs who helped cause the Great Recession. They call them “systemically important institutions” – as if they deserved gold stars. By the logic of the Bush and Obama administrations, however, they are the opposite. They are ticking time bombs. When they fail they will take down the global financial system. That makes them Systemically Dangerous Institutions (SDIs). Economists overwhelmingly believe that there are no “economies of scale” at the SDIs. Indeed, most economists believe that the SDIs are so large that they cannot be managed effectively.

It should, therefore, be a top public policy priority to end the ability of any single bank to pose a global systemic risk. That means that the SDIs should be forbidden to grow, required to shrink over a five-year period to a size at which they no longer pose a systemic risk, and that they be intensively supervised until they shrink to that size. In particular, that regulation of the SDIs must end the existing perverse incentives that are so criminogenic – executive compensation systems tied to short-term reported income, the accounting cover up which has gutted the Prompt Corrective Action (PCA) law, the use of compensation and hiring and firing powers to create a “Gresham’s” dynamic among the SDIs’ personnel and outside professionals, and the use of political contributions to impair effective regulation.

None of this has been done. In fact, the opposite has been done.

Both administrations have responded to the financial crisis by allowing (indeed, encouraging) SDIs, even insolvent SDIs, to acquire other failed financial firms and become even larger and more systemically dangerous to the global economy. The SDIs already intensely perverse incentives were made worse by giving them a bailout plus the accounting cover up of their losses on terms that made the U.S. Treasury and the Federal Reserve the “fools” in the market. The Bush and Obama administrations have made an already critically flawed financial system even more criminogenic.

This is significantly insane.

It appears that we will need to suffer another great depression before we are willing to to put aside the crippling theoclassical dogmas that have so degraded our financial system, real economy, democracy, and the ethical standards of our private and public elites.

If current domestic and international “reform” policies, e.g., the Dodd-Frank Act of 2010 and the “Basel III” proposals, are the limits of our response to the crisis then the Japanese scenario is the most probable outcome in the near and intermediate term. None of these reforms address the fundamental criminogenic incentive structures that are causing the recurrent, intensifying financial crises. The Japanese scenario would be a weak, delayed, and transitory recovery followed by periodic recessions. Banks would remain weak and a poor service of capital for economic expansion. Small and medium-sized banks would continue to fail in high numbers due to residential and commercial real estate (CRE) losses. The financial crisis has increased the long trend toward extreme concentration in financial industry.

The SDIs will pursue diverse business strategies. Some SDIs will continue their existing strategy of borrowing short-term at extremely low interest rates and reinvesting the proceeds primarily in government bonds. They will earn material, not exceptional, profits but will do little to help the real economy recover. Other SDIs will invest in whatever asset category offers the best (often fictional) accounting income. They will drive the next U.S.-driven crisis. (The next financial crisis to strike the U.S. may well come from the collapse of China’s multiple bubbles or financial and fiscal crises arising in the European Union.)

Marshall Auerbach

——–[Attachment 2]——–

Treasury Secretary Timothy Geithner tackles five myths about TARP

By Timothy F. Geithner Washington Post, Sunday, October 10, 2010; B03

http://www.washingtonpost.com/wp-dyn/content/article/2010/10/07/AR2010100705081_pf.html

Born at the peak of the financial crisis in 2008, the Troubled Asset Relief Program expired last week, ending what was perhaps the most maligned yet most effective government program in recent memory. Despite new evidence about the low ultimate cost and positive impact of the TARP, there is still a chasm between the perceptions of the program and its overwhelmingly favorable effect on the U.S. economy.

The TARP was doomed to be unpopular from inception, because Americans were rightfully angry that the same firms that helped create the economic crisis got taxpayer support to keep their doors open. But the program was essential to averting a second Great Depression, stabilizing a collapsing financial system, protecting the savings of Americans and restoring the flow of credit that is the oxygen of the economy. And it helped achieve all that at a lower cost than anyone expected.

As we put the TARP to rest, let's also put to rest some of the myths about the TARP.

1. The TARP cost taxpayers hundreds of billions of dollars.

The true cost of the financial crisis will always be measured by the devastating losses of jobs, homes, businesses, retirement savings and fiscal revenues. But the cost of the TARP, which succeeded in reducing the overall economic damage, will be considerably lower than once feared. In fact, the direct budget cost of the program and our full investment in the insurer AIG is likely to come in well under $50 billion — $300 billion less than estimated by the Congressional Budget Office last year. And taxpayers are likely to receive an impressive return (totaling tens of billions) on the investments made under the TARP outside the housing market.

Even looking beyond the TARP to the losses associated with Fannie Mae and Freddie Mac‘s pre-crisis mistakes, the direct costs of the government's overall rescue strategy are likely to be less than 1 percent of GDP. By comparison, the much less severe savings and loan crisis of the late 1980s and early 1990s cost 2 1/2 times that as a share of our economy.

2. The TARP was a gift for Wall Street that did nothing for Main Street.

Financial crises matter not because they hurt banks and bankers. They matter because they kill jobs, businesses and the value of retirement savings. To protect Main Street from the damage caused by a financial crisis, you must first put out the financial fire. That is precisely what the government did.

In the fall of 2008, the Bush administration injected nearly $250 billion into our largest financial institutions and provided a guarantee, for a fee, to help them continue to operate. Those emergency actions, taken at a time of grave danger for the U.S. economy, were absolutely essential. Without them we would have seen a broader collapse and losses of millions more jobs and trillions more dollars in income and savings.

Those initial investments, which came with limited conditions designed to protect taxpayers, helped stop the free fall of the financial system. But by the time President Obama took office, credit markets were still severely distressed and the economy was contracting at an accelerating rate.

So we shifted strategy to recapitalize the financial system with tough conditions and with private money, not public funds. And we focused resources directly on the victims of the crisis, rather than on the institutions that helped cause it. After inheriting nearly $300 billion in commitments, mostly to large companies, we directed resources toward lowering mortgage rates, reducing foreclosures and helping restart the credit markets for consumers and small businesses.

In addition to the nearly $300 billion in tax cuts in the Recovery Act for working Americans and businesses, the new initiatives on which we spent TARP funds were for broad-based programs to lower lending costs and mortgage payments. And where we inherited commitments to individual institutions — such as AIG and auto companies — we acted to ensure that those companies were fundamentally restructured so they could survive without government assistance and ultimately repay the taxpayer.

3. The TARP was a quick fix for the market meltdown but left our financial system weak.

The U.S. financial system has been completely overhauled and is in a much stronger position today than before the crisis. In fact, the weakest parts of the system are gone.

Of the 15 largest financial institutions before the crisis, four are no longer independent entities. Five were forced to restructure. Two have altered their legal form and are subject to much stricter federal oversight. Ten have seen major changes in senior management and boards of directors.

Investors in those institutions that didn't survive were wiped out. Investors in those that did faced substantial losses. Where firms could not finance themselves and the government was forced to take a large stake, our investments came with conditions that forced fundamental restructuring.

The firms that remain are less leveraged and hold much more capital (or financial reserves) against risk. They were forced by the stress tests we conducted to demonstrate that they could raise equity from private investors on the strength of their businesses.

4. The TARP worsened the concentration of the banking sector, leaving it more vulnerable to another crisis.

It is true that the financial system is more concentrated today than it was before the crisis. This was unavoidable, but our banking system is still much less concentrated than the systems of every other major country and represents a smaller share of our economy. We have 7,800 banks, not two or five, and we are less dependent on banks overall for credit, with securities markets and other financial institutions providing roughly half of all credit to businesses and individuals.

More important, the financial reforms enacted by Congress in the Dodd-Frank Act created stronger protections for consumers and against excessive risk-taking than existed before the crisis. They include greater transparency, tight limits on size and further concentration, and a clear prohibition on taxpayer-funded bailouts.

5. The TARP was the centerpiece of a strategy by President Obama to assert more government control over the economy.

The TARP was created by a conservative Republican president, who was also forced by the crisis to take over Fannie Mae and Freddie Mac, lend billions to the automobile industry and guarantee money-market funds. And the TARP was championed by the same Republican congressional leaders who are in office today. They deserve more credit for the courage they showed than they seem willing to accept now.

Before President Obama took office, the Bush administration committed nearly $300 billion under the TARP, including investments in banks representing more than three-quarters of the entire sector, two of the three big American car companies and AIG. That support was critical to preventing a complete system collapse, but it also represented a level of government involvement in our economy not seen since the Great Depression.

President Obama adopted a strategy designed to get the government out of the private sector as quickly as possible. To date, we have recovered more than $200 billion in TARP funds, as well as made $28 billion in profits. Our remaining investments in banks are a small fraction of what we inherited. And, in the end, 90 percent of that once-feared $700 billion TARP price tag either will not have been spent or will be returned to the taxpayers.

We will exit the AIG and automotive industry investments much faster than anyone predicted. General Motors is planning an initial public offering for later this year, and AIG has announced a restructuring plan that will accelerate the timeline for repaying the government.

The TARP is over. And as we put it behind us, it is worth noting that the financial security of all Americans is much stronger today than it would have been without the rescue strategy that the program made possible. It worked.

Timothy F. Geithner is secretary of the Treasury.

Want to challenge everything you think you know? Visit the “Five Myths” archive.

See Also:

Journal: Banks' Foreclosure ‘Robo-Signers' Were Hair Stylists, Teens, Walmart Workers–Lawsuit

Review: Rule by Secrecy–The Hidden History That Connects the Trilateral Commission, the Freemasons, and the Great Pyramids

Review: Tragedy & Hope–A History of the World in Our Time