Here Is Why The Dow Just Passed 13,000

Tyler Durden

ZeroHedge, 21 February 2012

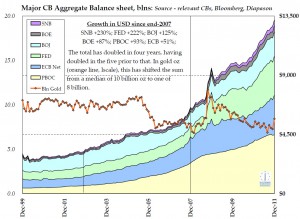

Wondering why the DJIA just passed 13K again? Wonder no more: as the chart below shows it is entirely due to the nearly $7 trillion pumped by global central banks into the world stock markets just in the past 4 years. As Sean Corrigan from Diapason notes, the aggregate global central bank balance sheet has doubled in four years, after doubling in the 5 years before that.

We would add that with the entire centrally planned ponzi scheme hell bent on preserving the illusion of nominal gains, global liquidity is now fungibly sloshing from one market to another with absolutely zero resistance whatsoever. At this rate, it should double again in 3 years, then 2, and so on. Will the Dow hit 52K in 5 years in that case? Why most certainly. Just ask any remaining citizens of the Weimar Republic. They know all too well about exponential stock market rises. They also know absolutely everything about the self-delusion that comes with chasing NOMINAL numbers. Oh, and before we forget, expressed in spot gold price, the central bank aggregate tally has moved from being the equivalent of 10 billion oz of gold, to just 8 billion. Guess what is 20% underpriced.

Phi Beta Iota: We disagree on the value of gold. You cannot eat gold and realistically you cannot trade gold. What clearly matters at this point is preparations for grid collapse — what do you do when electricity and water go off, and the food trucks and trains stop? There will be a MAJOR economic crash no later than 2014. Absent the emergence of a presidential TEAM such as conceptualized by We the People Reform Coalition, no one now running is qualified — all are lacking the combination of intellect, integrity, and a grip on reality — to get America out of this hole We the People have allowed an extraordinarily corrupt, greedy, and out of control 1% to create.