Beyond Regulators' Grasp How Shadow Banks Rule the World

By Martin Hesse and Anne Seith

Spiegel, 11/14/2012

Beyond the banking world, a parallel universe of shadow banks has grown in the form of hedge funds and money market funds. They're outside the reach of conventional financial regulation, prompting authorities to plan introducing new rules to prevent the obscure sector from triggering a new financial crisis. But in doing so they risk drying up an important source of funding to banks and firms.

Tango with the Tax Man Multinationals Find Loopholes Galore in Europe

Spiegel Staff

Spiegel, 11/14/2012

Large multinationals, many of them based in the United States, are masters at avoiding taxes on profits made abroad. Apple, for example, paid just $100 million in taxes in 2010 on overseas profits of $13 billion. But Germany would like to put a stop to the practice, and is finding some influential support.

Click Here to See Personal Page

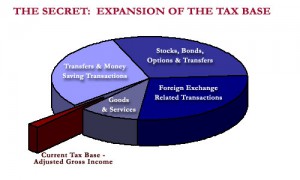

ROBERT STEELE: Integrity is not just about honor — it is about completeness — the integrity of the whole. Below is a graphic that shows the taxable elements of the economy. This is the same chart used by Dr. Edgar Feige to make the case for the Automated Payment Transaction (APT) Tax. The corruption of our government is two-fold. On the one hand, no one in political authority today (in contrast to civil servants that actually want to do right by the public) has intelligence with integrity. Ideology has replaced intelligence (decision-support), and party-line voting guided by the highest bidder has replaced integrity–we simply do not do ethical evidence-based decision-making in policy, acquisition, or even operations. What makes this particularly sad is that both of the parties are inherently correct in their root disposition: the federal government is twice as big as it needs to be, being 50% fraud, waste, and abuse; and a nation-wide safety net of entitlements such as education and health are a certain foundation for prosperity of the whole.

Unfortunately, both parties in power, so intent on keeping power and excluding all others (Independents, Constitution, Green, Libertarian, Natural Law, Reform, and Socialist), have lost touch with reality. They literally have no idea what the true costs are of their decisions, nor do they have any idea of what the alternative possibilities are for meeting the legitimate needs for revenue that can be applied to services of common concern. Also, a consequence of the convenience of monopoly power over the purse, both parties have traded the certain receipt of 5% pay-offs for 95% discounts on the public purse — cost plus government specifications took root in the military domain, and then proliferated across the other departments. What this means is that we buy things that we do not need, that do not work as they should, and that cost twice or more what they should.

Hence, the US government has lost its integrity (the ability to do holistic ethical evidence-based decision-making) in BOTH the means (revenue) arena, AND the ways (policy, procurement, & operations) arena, with ends that are at best incoherent (amateur hour over the Arab Spring) and at worst pathologically treasonous (935 uncontested lies taking us into Iraq and Afghanistan).

And now for what I believe to be the very good news — but I have had no success getting this idea considered, so if anyone reading this has access to anyone on the Hill (I do not), please make the best possible use of this information.

01. We do not have a fiscal cliff, we have an integrity chasm. The federal government began a devil's pack between the two parties under Ronald Reagan (I was a Reagan Republican vetted by Presidential Personnel (Jose Martinez for a Deputy Assistant Secretary of State position). They agreed that by borrowing a trillion dollars a year, we could have BOTH a near-socialist safety net AND a near-fascist police-military industrial complex. That one decision eliminates all restraint, all balance, and made both secret intelligence and unclassified decision-support irrelevant to policy, acquisition, and operations. The era of “anything goes” lasted until 2008 despite very detailed warnings on peak everything and bubbles from the mid 1980's forward. In our arrogant ignorance, we ignored reality.

02. The reason we had to borrow a trillion a year was that special interests refused to be taxed (e.g. stock and currency transactions are untaxed), and the government was limited in its taxing focus on gross adjusted income. As the chart above shows so clearly, this means that our means (revenue) is a fraction of a fraction of the whole. This is insane.

03. The Automated Payment Transaction Tax, by being a tiny tax on the order of less than half of one percent of every transaction, can generate $4 trillion a year without any difficulty at all, using existing credit card and bank cash machines. The ONLY negative is that it makes the tax code irrelevant, and that deprives Congress of its primary tool for extorting money from special interests, the waiver of complex unneeded regulations being the other. To that end, I propose that the same legislation that implements the APT Tax also double the salaries of Members, and make public funding the only option for all elections from local to federal.

04. More good news. Implementation of the APT Tax allows for the immediate and rapidly phased elimination of all other taxes. ALL other taxes. Not only can we eliminate the income taxes on the rich (last) but we can eliminate the income taxes on the poor, middle class (the tiny sliver that is left), and the small business owners that carry America on their backs. We eliminate payroll and social security taxes. We eliminate sales and estate taxes — the entire regulatory “tax and spend” government atrophies out of existence.

05. Even more good news. With this approach, we meet the Republican demand for tax reduction (going all the way to tax elimination), and we are now in a position, with ample funding, to recapitalize our human resources, our infrastructure, our national education, intelligence, and research networks, and our national security enterprise that desperately needs a complete make-over–a 450-ship Navy, a long-haul Air Force, an air-liftable Army, and the Marines back on the boats while the Coast Guard shares with the Navy the 100 new brown-water fast interdiction boats.

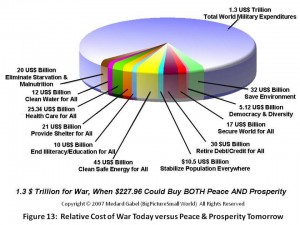

06. AFTER we get the country back on its feet, with Made in America restored, effective governance restored with a Congress that once again takes its Article 1 responsibilities and its power of the purse and the war decision seriously, then we start reducing the APT Tax rate at the same time that we reduce the size of the federal government–and of state and local governments. We must redirect our attention to the resilience of the local community, creating micro-grids and clean water and local organic agriculture across the land; new medium sized cities without skyscrapers, connected by high speed rail, and so on. Internationally, if we restore intelligence with integrity, we can eradicate all ten high-level threats to humanity for one third of the amount we have been paying for the instruments of war.

07. We do not face a fiscal cliff. We face an integrity chasm of our own making. It is time we reconnect our government to reality and our decisions to the public interest. The APT Tax is how we not only start, but acccelerate a return to America the Beautiful. IMHO.

Can anyone get this to the Speaker of the House and the President of the USA?

See Also:

Journal: Reflections on Integrity UPDATED + Integrity RECAP

Matt Taibbi: GRIFTOPIA – RECAP

Review: Lines of Fire – A Renegade Writes on Strategy, Intelligence, and Security

Review: The Principles of Representative Government

Review: Who Stole the American Dream?

Robert Steele: Intelligence for the President Revisited

Worth a Look: Book Review Lists (Positive)

Worth a Look: Book Review Lists (Negative)