Politicians love to talk about cutting taxes in order to stimulate the economy and create jobs, but do tax cuts really trigger economic growth?

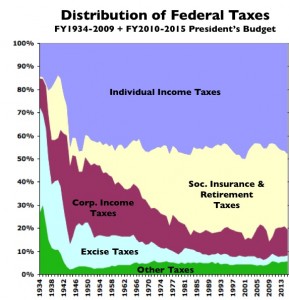

Let's look at the federal government's tax take. The attached chart portrays the portrays how each category of taxes changed as a percentage of the Federal Government's total tax receipts since 1934. It tells us that income taxes fluctuated up and down but remained relatively constant as a percentage of the total tax take since 1946. The biggest percentage increase occurred in Social Security and Medicare taxes, which also happen to be the most economically regressive taxes in the tax structure (i.e., the tax burden is relatively higher for those at lower incomes than for those at higher incomes). The biggest share declines occurred for corporate income taxes, excise taxes, and other taxes (estate taxes, customs duties, and miscellaneous taxes).

Let's look at the federal government's tax take. The attached chart portrays the portrays how each category of taxes changed as a percentage of the Federal Government's total tax receipts since 1934. It tells us that income taxes fluctuated up and down but remained relatively constant as a percentage of the total tax take since 1946. The biggest percentage increase occurred in Social Security and Medicare taxes, which also happen to be the most economically regressive taxes in the tax structure (i.e., the tax burden is relatively higher for those at lower incomes than for those at higher incomes). The biggest share declines occurred for corporate income taxes, excise taxes, and other taxes (estate taxes, customs duties, and miscellaneous taxes).

Few would argue that the period of most stable growth in the post-WWII US economy occurred between 1946 and the mid 1970s, at least when viewed as a composite of measures like productivity growth, healthy trade balances, productivity growth, real growth in personal income, low unemployment, relatively high job security, relatively small federal deficits, and relatively mild recessions.

Since the advent of the tax cut mania, beginning with Proposition 13 in California in 1978, and institutionalization of the easy, albeit imbalanced politics of tax cutting, deregulation, and high defense spending by Ronald Reagan in 1981, and again by Mad King George in 2001, the American economy has been punctuated by periodic financial crises and sharp recessions with high unemployment, massively increased federal deficits, a disastrously plummeting trade balance, massive deindustrialization (even though Corp taxes were a lower share of the tax take than during the earlier, more economically robust period ), periodic calls to cut social insurance benefits but not cuts in the regressive taxes for Medicare and Social Security (which is currently running a huge surplus).

This raises the obvious question of whether the politically easy road launched by Ronald Reagan creates more enduring economic problems that it solves?

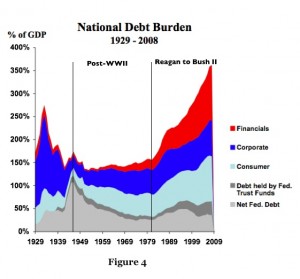

This ought to be a question of great importance when trying to figure out how to stimulate an economy that is in the the greatest economic crisis since the Great Depression and even more mired down more by the unprecedented burdens of private debt (a clear product Reagan/Clinton/Bush deregulation policies) than by public debt (primarily the product Reagan and Bush II) — as is abundantly clear from the following chart.

This ought to be a question of great importance when trying to figure out how to stimulate an economy that is in the the greatest economic crisis since the Great Depression and even more mired down more by the unprecedented burdens of private debt (a clear product Reagan/Clinton/Bush deregulation policies) than by public debt (primarily the product Reagan and Bush II) — as is abundantly clear from the following chart.

SECOND CHART

Yet again we are hearing calls for more tax cuts, and efforts to re-regulate the to-big-fail banking sector are stalled. Many politicians, especially Republicans, are now calling for more tax cuts in order to trigger a recovery. Paradoxically, these calls for tax cuts (in the name of job creation) are accompanied by calls to reduce the deficit (which could put the brakes on job creation), but they want the core defense budget, although at an all time, to be again is off limits (a pressures that Obama just caved into). The grease lubricating the political debate in the US is a welter of contradictory and simplistic slogans.

But, as the above charts imply, and the brief introductory discussion by James Kwak below shows, the tax cutting issue is anything but as simple and straightforward as its advocates would have us believe.

Maybe it is time for the politicians to step back and take a deep breath and begin to think what they are really trying to accomplish.

Chuck

The Baseline Scenario

What happened to the global economy and what we can do about it

Taxes By James Kwak with 106 comments

But, I hear you saying (and emailing) after my last few posts, higher taxes are bad for the economy because people don’t work as hard, making the pie smaller for everyone.

Yes, that’s what it says in the textbook. But the issue is more complicated than that. Look at this, for example:

Click here or on Taxes to see two charts and comment.