Everything You Need To Know About Europe In Three Charts

Tyler Durden

Zero Hedge, 30 January 2012

Juxtaposing Merkel's (righteous and principally correct) insistence on debt brakes and fiscal discipline with the socialist tendencies of her European (let us print) comrades is at the heart of the crisis in Europe.

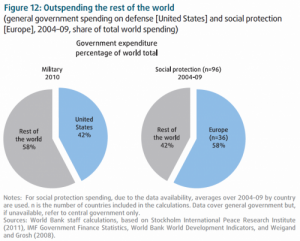

Nowhere is that more apparent than in these three charts, from the World Bank, which highlight just how large in absolute and relative terms Europe's social protection based government spending has become. This situation will only get more demanding as by 2060 almost a third of Europeans will be over 65 years old. While there was a belief that Europeans were willing to accept less growth for better growth (cleaner, smarter, kinder?), in order to meet the needs of an increasingly heavy ‘social' burden, government debt brakes will clearly have to be unhitched further, no matter what Merkel demands (increasing tensions), or the ‘new growth model' that is heralded but not yet substantive will have to be a miracle.

World Bank: THE PRECIPITATE PROMISE OF SOCIAL PROTECTION

Europe will have to make big changes in how it organizes labor and government. The reasons are becoming ever more obvious: the labor force is shrinking, societies are aging, social security is already a large part of government spending, and fiscal deficits and public debt are often already onerous.

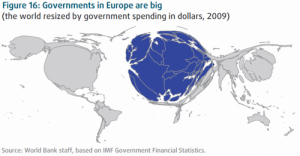

In dealing with government spending, deficits, and debt, it is sensible to start by asking whether European governments are too big; that is, whether they spend too much. They are obviously bigger than their peers. In the EU15, governments spent 50 percent of GDP in 2009; in much of the rest of Europe, this share was about 45 percent—versus less than 40 percent in the United States and Japan, 33 percent in Latin America, and about 25 percent in emerging East Asia. A map of the world resized to reflect government spending instead of land area shows how Europe might look to outsiders (figure 16 below).

Read rest of article, see additional chart.

Phi Beta Iota: Three themes jump out. First, governments are too big, will fail, the era of small government leveraging new tools and new ways and new mindsets is emergent. Second, the US overspends on the military and Europe overspends on social protection–both of these are culturally-insulated forms of corruption. Third, the Industrial Era model of making decisions and allocating resources is no longer affordable and needs to be abandoned. Assuming that national government refuse to heal themselves, we see local and state jurisdictions becoming very aggressive about resilience and sustainability, to the point of nullifying national regulations and if necessary declaring secession. It is noteworthy that those governments that refused to bail out the banks and instead turned to their public for common sense solutions, are now the strongest governments.