Mr. President,

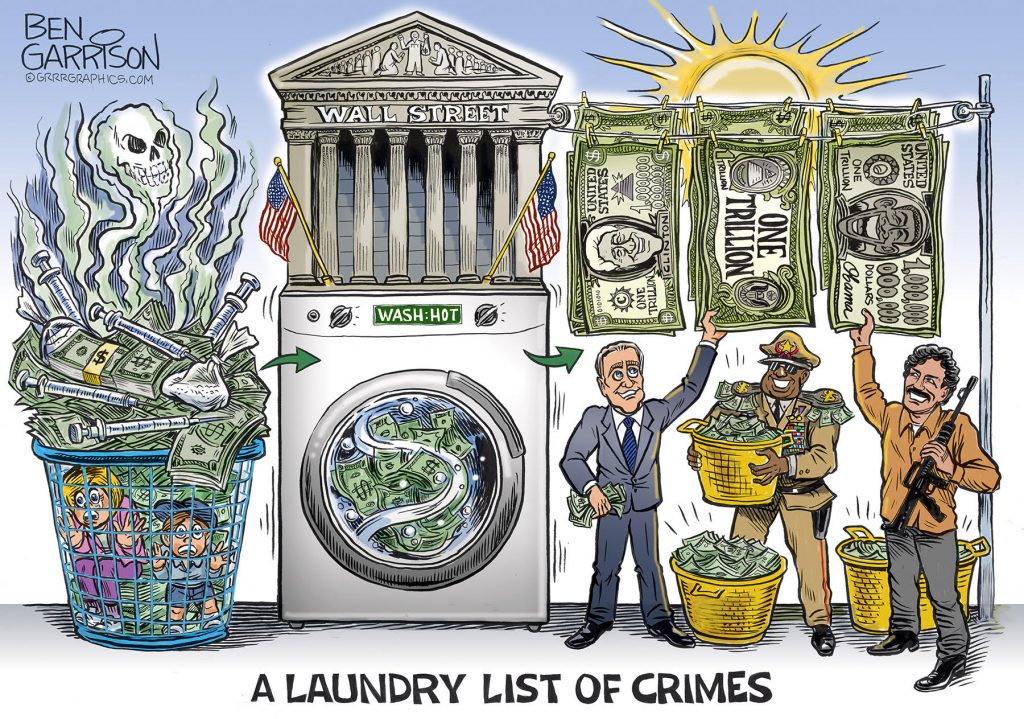

Mr. Robert David Steele and I were recently introduced by mutual acquaintances. All of us share one major conviction. We believe that hedge funds working in collusion with certain elite Wall Street investment banks are engaged in a long running, unbelievably broad, criminal enterprise to manipulate stocks. (I have labeled the participants as the wolfpack.) This scam defrauds investors of hundreds (yes hundreds) of billions of dollars each year and causes incalculable damage to companies, particularly the emerging companies that are most vulnerable to their stock manipulation. Integral to their strategy is the use of illegal naked shorting to create and sell huge amounts of counterfeit stock to depress stock prices. This is a crime against society as it is these entrepreneurial companies that most often lead technological evidences that drive the American economy.

The wolfpack is driven by insatiable greed. It is not enough to have a home in Greenwich, a summer home in the Hamptons, a condo in Miami, an apartment in New York City, a ski chalet in Aspen, private planes, cars, ad infinitum. They just want to make their next billion dollars and if it means destroying a small company trying to develop a vaccine for brain cancers, this is just business as usual. Most recently, I have watched with consternation attacks on Gilead which is developing a therapeutic for Covid-19 (remdesivir) and Moderna which is developing a vaccine for Covid-19. The wolfpack was successful in driving down the stock prices of Gilead and Moderna as well as the market as a whole using bloggers to spread negative fake news and then pounding the stocks with shorts. These were nice scores for the wolfpack. This sounds like wild hyperbole, but sadly I do not believe that I am overstating the case and if you decide to look further, I think you will agree.

Mr. Steele originally asked me to do an interview with him. In preparation, I prepared an outline. After looking at it, he suggested it might be more effective to publish the outline. This work is just a perfunctory overview of the research that I have done on stock manipulation. It is meant to give you an overview and hopefully will whet your appetite to dig deeper. I want to reemphasize this outline is a simplistic description of a very complex scheme that Wall Street has perfected over 30 years. If you would like more information, I would urge you to go to a series of ten articles that I have published on my website, SmithOnStocks.com. Here is the link.

https://smithonstocks.com/?s=illegal+naked+shorting

My Background

- Born April 3, 1944. Grew up in Brazil, Indiana. My father and both grandfathers were coal miners.

- BS Mechanical Engineering, Purdue, 1966

- MS Mechanical Engineering, Stanford, 1968

- MBA, Columbia 1970

- Began career on Wall Street as an analyst in 1970

- My specialty was pharmaceuticals and later biotechnology

- Became Director of Research at Smith Barney in 1982, Board of Directors, Operating Committee

- Became Director of Research at Hambrecht and Quist in 1989, Operating Committee. I ran the H&Q healthcare conference from 1989 to 1994, now known as the JP Morgan conference

- Began my own consulting firm in 2004 and later started a blog called SmithOnStocks specializing in research on emerging biotechnology stocks

- I haven’t drawn a paycheck since 2004. Some people might suggest that I am retired. However, I am stimulated by the explosion of technology in biopharma and still put in a lot of hours every week. Income from SmithOnStocks blog is inconsequential to my life.

Stock Manipulation Using Illegal Naked Shorting- How My Awareness Built

- It was after starting my blog about six years ago that I became increasingly aware of stock manipulation

- Biotechnology stocks are extremely vulnerable because they must invest huge amounts of capital over several years developing drugs, before becoming profitable and clinical trials are risky and have high failure rates. Investment in these companies is fraught with uncertainty that stock manipulators thrive on.

- My focus is on smaller biotechnology companies that are not well covered by Wall Street. I try to identify companies that are poised for a significant event such as completion of as clinical trial, which if successful, could lead to a strong upward stock movement.

- To my great shock, I saw time and again that when companies reported a positive event, the stock would start moving up as I expected and then the stock would take a sharp nosedive. I was initially baffled, but over time I came to believe this was because stock manipulators were significantly short the stock and to protect their short positions couldn’t allow an upward move. With illegal naked shorting, they could sell countless counterfeit shares that would overwhelm demand for the stock.

- If the news was equivocal or disappointing, the stock would get absolutely crushed beyond reason.

- Usually and shortly after the announcement, some blogger on social media would publish a slanted, distorted article spinning that the news was negative. These article are unwaveringly vicious. Then there would be lawsuits filed alleging that management had made material misrepresentations. Oh yes, securities lawyers specializing in shareholder suits are proud participants in the wolfpack.

- So, on good news, the stocks of many companies would go down and on equivocal or uncertain news they were crushed.

- At first, recognizing that I was dealing in high risk emerging growth stocks, I thought this was just a consequence of companies I was involved with. However, I began to see that it was pervasive and that many other investors independently were seeing the same alarming stock behavior and concluding like me that stock manipulation was going on.

- This was also coincident with some bloggers gaining great notoriety for their great stock picking prowess and some short sellers putting up extremely strong results. The bloggers were fronting for the short sellers and often times it was the short sellers who were also blogging.

- Another common ploy of the wolfpack is to establish a big short position in a stock and then publish a highly inflammatory bearish article. This is followed by aggressive, illegal naked shorting. Seeking Alpha has become the preferred venue for such articles.

- I had never before entertained the thought that there could be a coordinated scheme between bloggers, short sellers, securities lawyers and market makers to manipulate not just one stock on an occasional basis, but to apply the scheme to a broad, broad universe of companies.

- The realization that this was actually happening prompted my quest to understand what was going on.

Let Me Tell You My Conclusions on Stock Manipulation Before I Explain How It Is Done

- Stock manipulation is pervasive and routine on Wall Street. It has evolved over the last 30 years into a routine business practice.

- Hedge funds routinely use social media and manipulation of the mainstream media to accuse companies of lying about their company and not maintaining management is acting criminally to pump up the stock price.

- The real damage to stocks, however, is done by illegal naked shorting that can create millions of counterfeit shares that can overwhelm buying demand.

- Shockingly, the firms doing the illegal naked shorting are the trading desks of elite, household names, Wall Street investment banks.

- Illegal naked shorting goes hand in hand with stock lending. I have seen estimates that this accounts for as much as 20% or 30% of profits of elite Wall Street investment banks. It is core to their business model.

- How can this be? You have to understand how stock trading is done in the US

- Essentially all stock transaction in the US are handled by The Depository Trust & Clearing Corporation (DTCC). It provides clearing and settlement services to the financial exchanges that handle nearly all securities and cash transfers on behalf of buyers and sellers.

- The Depository Trust Corporation (DTC) is a subsidiary of the DTCC. It is the depository for almost all US securities and keeps records of transfers through electronic record-keeping of securities balances.

- The National Securities Clearing Corporation (NSCC) is also a DTCC subsidiary that provides clearing and settlement for almost all securities transactions in the US two days after a transaction (T+2). It also guarantees completion of certain broker-to-broker securities transactions.

- The DTCC is a private company that does not come under the close scrutiny of regulators as would be the case if it were a public company. What goes on in the DTCC stays at the DTCC; its transactions are clouded in secrecy. There is almost zero transparency. In theory, the SEC is the regulatory agency for the DTCC, but the SEC has designated the DTCC as a self-regulating entity and pretty much leaves it alone.

- Guess who owns DTCC? The elite Wall Street investment banks who are facilitating the illegal naked shorting and stock manipulation.

- What about the SEC? There have been many, many attempts to get the SEC to step in and stop illegal naked shorting. Routinely, the SEC has sided with Wall Street and against investors. The agency has been captured by Wall Street. Many of its employees aspire to going to high paying jobs on the Street after a brief stint at the SEC. They are not inclined to investigate what may be their future employers.

Wall Street, Not Investors, Owns Almost All of Stocks Traded in the US

- Here is the real shocker. When investors execute a buy order for a stock, most think that somewhere there is a document showing that they are partial owners of that company. We are told that buying a stock means that you own a piece of America. This is not true.

- Almost all registered stock in the US is held by a private partnership owned by DTCC called CEDE which in turn is owned by the elite Wall Street firms that are involved in the stock manipulation.

- Do you see a pattern here?

Why DTCC and CEDE Were Created

- The origin of the DTCC was in the 1960s. Until then the buying and selling of stocks was much like buying and selling anything else. Upon the execution of a trade there was a settlement in which the seller delivered a stock certificate and the buyer delivered cash. The buyer did indeed own part of a company when they purchased shares.

- As trading began to grow, this slow labor intensive system broke down and nearly paralyzed Wall Street’s ability to handle trades.

- The answer was to create an electronic trading system. This crisis was concurrent with the rise of mainframe computers that made electronic trading possible for the first time.

- A big problem to solve was what to do about the stock certificates. The answer was to replace them with electronic bookkeeping entries and in order to do this the stock certificates had to be dematerialized.

- The dematerialization solution required all companies that wanted to trade on national exchanges to place all of their registered stock under the ownership of CEDE.

- A financial derivative for stocks was created that corresponded on a one to one basis to registered shares held by CEDE. These are street name securities for which CEDE is the nominee. They grant to the holder the rights to dividends, corporate governance and most other aspects of stock ownership except for actual ownership.

- Street name securities are held by prime brokers like Goldman, Merrell etc. They trade these financial derivatives back and forth with other prime brokers.

- When we individual investors enter buy and sell orders, the prime brokers become the nominee and credit us through an electronic book entry that corresponds one to one with street name securities. Hence, we individual investors are buying a financial derivative of Street name securities which in turn are financial derivatives of registered stock owned by Cede.

- We are not buying stock in a company. We have bought a commodity that is a second financial derivative of registered stock.

- This commoditization of stocks issued by companies makes Street name securities and the financial derivative of Street name securities that investors hold indistinguishable. This allows the DTCC system to create millions and billions of counterfeit shares.

How DTCC Uses Continuous Net Settlement to Settle Trades

- This is really complex and I am not sure I can convey this idea in a few words. It took me several months to come to a rudimentary understanding. If you have trouble following me, I would urge you to go to the link to my website that I earlier provided.

- Many investors think that if they are buying a stock, their broker has to find someone who is selling and match the orders. That is almost never the case.

- Your order is quickly executed without finding a direct counterparty. The prime broker doing the trade may make many, many trades throughout the day. Instead of matching each buy to a specific sell, all of the buy and sell orders are netted at the end of the day. This is called continuous net settlement. This would not be possible with registered shares, but street name securities and the derivative of street name securities that are in investors accounts are indistinguishable commodities.

- Prime brokers at the end of the trading day may have a surplus or deficit of street name securities. If there is a deficit, they must borrow from a prime broker with a surplus or the NSCC and vice versa.

Creating Counterfeit Shares

- It is hard to try to distill this complex process into this limited discussion. I hope you have gotten the idea that no outsider knows what is going on as the derivatives of registered stocks are swiftly passed to and fro. The DTCC may know but nobody else does. This permits much illegality.

- Let’s turn to market makers now to try to understand how counterfeit shares are created through illegal naked shorting.

- Regulation SHO is the key SEC regulation that covers how a market maker can legally use naked shorting if they can not immediately borrow stock for an investor giving them a short order.

- Reg SHO allows the market maker to sell stock that they do not own, two or in some cases six days to find some investor to loan them the stock they have just shorted if the market maker believes that it can legitimately find stock to borrow in that time frame.

- In the interim, the NSCC will borrow stock from somewhere else to loan to the short seller. If the market maker does not find shares to borrow, counterfeit shares can be created. Here is how it works,

- Investor-Shortseller issues an order to short 100 shares of stock in company XYZ.

- A market maker sells 100 shares of XYX to Investor- One who is credited by the DTC with owning 100 shares of XYX

- If the market maker can’t find shares to borrow, the NSCC steps in to fill the order by borrowing shares from Investor- Two who is still credited with owning 100 shares of XYZ.

- If the market maker can not find 100 shares of XYZ to borrow, we are in the position that Investor-One Investor-Two own the same 100 shares. Presto, 100 shares have been counterfeited.

- If the market maker can not borrow the stock in the allowed time frame, the trade is labeled as a fail to deliver (FTD). Reg SHO states that the broker who bought the shares created by the naked short can require that the stock be bought in the open market. This never happens. They are both in on the scam and help each other out.

- The FTD can be papered over by the first market maker going to a second colluding market maker. The second market maker naked shorts shares to the first market maker and the FTD disappears. The a few days later the process is repeated so that the naked short is rolled over time and again.

- Quite frequently, the FTD is just ignored. The SEC has shown almost no interest in addressing this situation.

- What I have just described is just part of a much more complex process to create counterfeit shares. There is a whole lot more to this than what I have just laid out, but you get the idea.

Classic Example of Counterfeiting

- Global Links Corporation is an example of how wholesale counterfeiting of shares will decimate a company’s stock price. Global Links is a company that provides computer services to the real estate industry.

- By early 2005, their stock price was subject to massive shorting and had dropped to a fraction of a cent. At that point, an investor, Robert Simpson, purchased 100%+ of Global Links’ 1,158,064 issued and outstanding shares.

- He immediately took delivery of his shares and filed the appropriate forms with the SEC, disclosing he owned all of the company’s stock. His total investment was $5,205 that was purchased at a price of $.00434.

- The day after he acquired all of the company’s shares, the volume on the over-the-counter market was a staggering 37 million shares. The following day saw 22 million shares change hands. This was all without Simpson trading a single share. These were all counterfeit shares.

Have I Gone Over the Top?

- Wait a minute Smith. You have gone completely over the top. You are ignoring how efficient the market is in handling trading. The NYSE and NASDAQ handle trades amounting to nearly $3 trillion per month.

- This is done almost seamlessly. Look idiot, the markets are working and we can’t afford to mess with a good thing. Besides, how could we improve on the DTCC system?

- In regard to improving on the DTCC system, there is one compelling answer. That is to create transparency which is almost non-existent with the DTCC.

- It is true that the trades are being done with great speed and dependability. The problem is that we investors are also being ripped off by Wall Street at the same time. We just can’t see how no matter how hard we try.

- Let me go far beyond my level of expertise to suggest that there is likely to be a fairly straightforward solution.

- Computer power today is unbelievable. High frequency traders, who have their own little scams going on, can execute hundreds of trades in a second.

- It seems that a system like this can be programmed to create the best possible trades for investors based on natural order flow and would not be that difficult to design.

See Also: