Are We Approaching Peak Retirement? (October 15, 2013)

If stocks, bonds and real estate all decline going forward, where are pension funds going to earn their 7+% annual yields?If we look at the foundations of retirement–Social Security, stocks, bonds and real estate–it seems we may have reached Peak Retirement. Let's start the discussion by noting that the primary Federal retirement programs–Social Security and Medicare–are “pay as you go,” meaning the checks sent out to beneficiaries this year are funded by payroll tax revenues collected this year from workers.

As Mish and I (as well as others) have tirelessly pointed out, the “trust funds” for these programs are phantoms of imagination. When these programs run deficits, the government raises the money to fund the deficit the same way it funds all its deficit spending–by selling Treasury bonds.

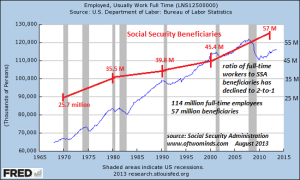

These programs were founded on a demographic illusion, i.e. that the number of retirees (beneficiaries) would magically remain a small percentage of the workforce paying payroll taxes. Alas, the number of beneficiaries is rising fast while the number of full-time workers is stagnating.

Full-time employment and the number of Social Security beneficiaries: the ratio of full-time workers to beneficiaries is already 2-to-1, and set to decline. Below 2-to-1, either payroll taxes will have to icnrease or benefits will have to be trimmed, or some of both.