Below are three separate contributions: Spinney on Sprey; Sprey on Boeing; and Seattle Times on Boeing.

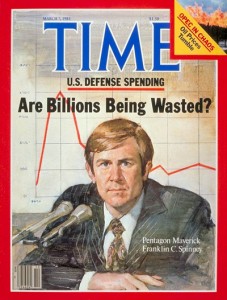

CHUCK SPINNEY SOUNDS OFF

President Obama says that restoring America’s competitiveness is one of his top priorities. Yet under his watch, deindustrialization, financialization, and globalization continue without interruption. Many advocates of defense spending argue that spinoffs from the Pentagon's R&D and high tech engineering practices are keys to reinvigorating America’s manufacturing economy. For whatever reasons, Mr. Obama shows no intention of reining in defense spending by anything more than a cosmetic amount, even though the defense budget is higher now that at any time since the end of WWII (after removing the cumulative effect of 60 years of inflation), and despite the fact that the United States is spending about as much on defense as the rest of the world combined.

Let us hope Obama has not bought into the bogus arguments that spending more on defense will be good for restoring competitiveness in the manufacturing sector of the American economy.

Defense spending may be necessary, but it can not be justified on the grounds of increasing general industrial competitiveness. In fact, the so-called spinoffs offs from Defense spending can transmit the corrupting effects of the politically motivated, cost-plus economics of the Military – Industrial – Congressional Complex (MICC) into the larger economy The MICC not only subsidizes wasteful cost growth in the Pentagon, its activities infect the overall economy by soaking up scarce investment and human capital; corrupting the practices of science and engineering; distorting research content on a huge scale; while providing incentives for inefficient production and management practices, (e.g. excessive outsourcing for political reasons – aka the political engineering practices explained here and here), not to mention the politicizing of industrial management.

It is no accident high wage countries that spend a smaller proportion of their GDP on defense, like Germany, have more competitive industrial manufacturing sectors than the United States. To quote, William Anders, former CEO of General Dynamics, “most [weapons manufacturers] don’t bring a competitive advantage to non-defense business,” and “Frankly, sword makers don’t make good and affordable plowshares.” [see page 58 and end note 4, The Domestic Roots of Perpetual War]

In the past, many defenders of the spillover effects of high-defense budgets invoked the competitive nature of Boeing Corporation as counterpoint disproving the preceding statements. Boeing is a company that has been competitive in the commercial international aerospace markets, has been a major export earner, and is a huge defense contractor to boot. Surely, Boeing is an example of serendipity and spinoff in the defense-private sector combination!

But wait, the Boeing 787 is shaping up to be a disaster, at least from a cost overrun standpoint. Can it be that the corrupting effects of defense spillover, plus the not unrelated dysfunctional affects financialization and outsourcing of production, have finally caught up with Boeing and are now dragging Boeing’s commercial competitiveness into the dustbin of commercial history, as these practices did earlier in commercial airliner production efforts of the Douglas and Lockheed and Martin corporations? Is Boeing about to become the next welfare queen sucking at the Defense teat.

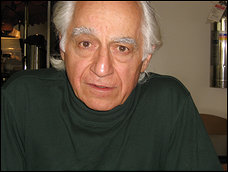

I asked my good friend Pierre Sprey for his opinion. Sprey is a brilliant engineer and a long time critic of defense design pathologies. In fact, I call Pierre the All-Purpose Schwerpunckt because of his wide range of interests, knowledge, and the pithiness of his analyses. He responded in his typical fashion, citing a 5 February report in the Seattle Times to buttress his argument. Moreover, the Times report cites a brilliant internal Boeing Report, written in 2001 by Dr L. J. Hart-Smith, that describes the disastrous economic effects of excessive outsourcing that is now dragging Boeing down. Hart-Smith reinforces Pierre’s points in spades (particularly Pierre's comment about political engineering*), although Hart-Smith’s paper is focused entirely on commercial applications!

Attached herewith is Sprey’s diagnosis of Boeing and the effects of defense management practices on Boeing’s competitiveness in commercial markets and the Seattle Times report triggering Pierre's analysis. After reading this, I would urge you to study Hart-Smith's important report.

*FYI, the theory and practice of political engineering by all the players in the MICC are explained here and here.

Chuck Spinney

PIERRE SPREY HOLDS FORTH

Why Boeing Is Imploding

Pierre M. Sprey

8 February 2008

Boeing has been making money on commercial airliners for 60 years by creating and enforcing a wall between their military and their civilian manufacturing divisions. Their latest and largest-ever commercial venture, the 787, has turned into a classic DoD-style fiasco, with huge engineering, quality control, schedule and cost screwups. They have overrun their planned $5 billion investment by a breathtaking $12 to $18 billion. You don't have to be wearing a deer-stalker hat to deduce that the rotten practices bred by DoD procurement have finally infected the executive suite of Boeing's commercial division. The Seattle Times story below lifts a corner of the rug, revealing that the rot began when Boeing merged with McDonnell-Douglas–and when McDonnell executives began introducing the same mindless management techniques that had wrecked Douglas as a commercial aircraft producer.

An in-depth history of the 787 Dreamliner disaster would almost certainly uncover the following lessons:

– The simple-minded Harvard Business School style focus on percent return on investment–combined with the executive greed engendered by outrageously excessive compensation geared to stock prices–was at the root of the Dreamliner's initial financial mismanagement and the subsequent years of financial coverup.

– Boeing's heavy outsourcing strategy (intended to bring in investment money and to sweeten overseas marketing deals) certainly caused the Dreamliner's engineering failures, disastrous loss of quality control, endless and uncontrollable schedule delays. These are exactly identical to the disastrous consequences of the DoD-encouraged outsourcing to subcontractors in 40 or more states (i.e., “political engineering”) that wrecked the C-5, F-22 and F-35 programs.

– Bringing into the Dreamliner team engineers from Boeing's military programs undoubtedly brought in lots of DoD's engineering malpractices: unwarranted avionics complexity; reliance on untested and overtouted composite materials; wishful thinking projections of weight, drag and production cost; use of finite element analysis, computational fluid dynamics and simulation modeling to replace solid hardware testing.

In short, the Dreamliner stands as a perfect paradigm of the profoundly negative spinoffs for the U.S. economy of DoD (and NASA) high tech spending–exactly the problem that Ernie Fitzgerald (see The High Priests of Waste) and Seymour Melman (see The Permanent War Economy and Profits Without Production) warned us about over 35 years ago.

Pierre

THE STORY IN SEATTLE

SEATTLE TIMES Saturday, February 5, 2011

A ‘prescient' warning to Boeing on 787 trouble

Boeing commercial airplanes chief Jim Albaugh had some unusually candid comments about the 787's global outsourcing strategy at a recent Seattle University talk.

Seattle Times business staff

Related

In a late January appearance at Seattle University, Boeing Commercial Airplanes Chief Jim Albaugh talked about the lessons learned from the disastrous three years of delays on the 787 Dreamliner.

One bracing lesson that Albaugh was unusually candid about: the 787's global outsourcing strategy — specifically intended to slash Boeing's costs — backfired completely.

“We spent a lot more money in trying to recover than we ever would have spent if we'd tried to keep the key technologies closer to home,” Albaugh told his large audience of students and faculty.

Boeing was forced to compensate, support or buy out the partners it brought in to share the cost of the new jet's development, and now bears the brunt of additional costs due to the delays.

Some Wall Street analysts estimate those added costs at between $12 billion and $18 billion, on top of the $5 billion Boeing originally planned to invest.

Interviewed after the Seattle U. talk, Albaugh avoided directly criticizing the decisions of his predecessors.

The 787 outsourcing strategy was put place in 2003 by then-Boeing Chairman Harry Stonecipher, who was ousted in 2005, and Commercial Airplanes Chief Alan Mulally, now chief executive at Ford.

“It's easy to look in the rear-view mirror and see things that could have been done differently,” Albaugh said. “I wasn't sitting in the room and I don't know what they were facing.”

And yet, at least one senior technical engineer within Boeing predicted the outcome of the extensive outsourcing strategy with remarkable foresight a decade ago.

Albaugh and other senior leaders within Boeing may be belatedly paying attention to a paper presented at an internal company symposium in 2001 by John Hart-Smith, a world-renowned airplane structures engineer.

Hart-Smith, who had worked for Douglas Aircraft and joined Boeing when it merged in 1997 with McDonnell Douglas, was one of the elite engineers designated within the company as Senior Technical Fellows.

His paper was a biting critique of excessive outsourcing, a warning to Boeing not to go down the path that had led Douglas Aircraft to virtual obsolescence by the mid-1990s.

The paper laid out the extreme risks of outsourcing core technology and predicted it would bring massive additional costs and require Boeing to buy out partners who could not perform.

Albaugh said in the interview that he read the paper six or seven years ago, and conceded that it had “a lot of good points” and was “pretty prescient.”

In his talk at Seattle U., the first specific lesson Albaugh cited as learned from the 787 debacle seemed to echo Hart-Smith's paper.

Albaugh said that part of what had led Boeing astray was the chasing of a financial measure called RONA, for Return on Net Assets.

This is essentially a ratio of income to assets and one way to make that ratio bigger is to reduce your assets. The drive to increase RONA thus spurred a push within Boeing to do less work in-house — hence reducing assets in the form of facilities and employees — and have others do the work.

Hart-Smith argued that it was wrong to use that financial measure as a gauge of performance and that outsourcing would only slash profits and hollow out the company.

Reached by phone in his native Australia, where at 70 he is now retired, Hart-Smith said he'd heard in recent months on the grapevine from former colleagues that senior executives at Boeing Commercial Airplanes have been reading his paper.

“I'm glad they got the message,” Hart-Smith said. “It took far too long.”

After he presented his paper at a company symposium in 2001, he received hundreds of supportive e-mails from engineers and lower-level managers, he said.

But a senior executive present at the symposium spent a half-hour after his presentation attacking the paper, and afterward Boeing leadership ignored Hart-Smith.

He had hoped to join the 787 program but wasn't permitted to do so. He felt sidelined, he said.

In Hart-Smith's analysis, the seeds of Boeing's outsourcing ideas grew out of the McDonnell aircraft business, which focused on military-airplane programs. On the military side of the business, the U.S. government was the major, often the only, customer and it funded development costs in full.

“The military approach didn't require you to risk your own money,” Hart-Smith said. “That was the McDonnell Douglas mentality.”

He blamed that attitude for the major outsourcing on the MD-95 and proposed MD-12 programs, the failure of which led to the decline of Douglas' commercial-airplane business in California.

The same ideas were transferred to Boeing with the McDonnell Douglas merger and led directly to the 787 outsourcing strategy, he said.

Taken to its extreme conclusion, Hart-Smith said mockingly, the strategy of maximizing return on net assets could lead Boeing to outsource everything except a little Boeing decal to slap on the nose of the finished airplane.

Though most of the profits would be outsourced to suppliers along with all the work, and all the company's expertise would wither away, the return on investment in a 25-cent decal could be 5,000 percent.

Has Boeing belatedly seen the light and embraced Hart-Smith's analysis?

Clearly the 787 has brought a serious rethink at the top.

“We went too much with outsourcing,” Albaugh said in the interview. “Now we need to bring it back to a more prudent level.”

That likely includes building the horizontal tails of the next version of the Dreamliner, the 787-9, in the Seattle area. And for the next all-new airplane that Boeing will build, Albaugh vows that “we can do things differently and better.”

“Doing the new airplane the way we did this one is not what we want to do.”

But the rethink may not be as radical as Hart-Smith would like.

In his paper he wrote that while some selective outsourcing is necessary, Boeing should keep most of the work it has traditionally done in-house.

Albaugh balked at going that far.

“I haven't said keep most of the work in-house,” Albaugh said. “I still believe we need to make sure we try to access the best technologies and capabilities that are available around the world.”

And despite what Hart-Smith has heard on the grapevine, no one from Boeing's leadership has actually called him up to talk about his analysis.

Hart-Smith retired from Boeing in 2008. He still presents engineering papers at academic conferences around the world.

Yet that startlingly prescient 2001 paper focused on business economics. Where did a structures engineer get that kind of expertise?

“It's common sense,” Hart-Smith said.

— Dominic Gates

Phi Beta Iota: What many do not realize is that the same pathologies of power uninformed by intelligence have been extended to all other spheres including education, family, health, and justice. The government–and society–have become hollow, and the “true cost” of such irresponsible practices is vastly greater than the mere financial deficit. We've eaten our seed corn and poisoned the fields to boot.

We are in the process of developing a new article on “The Science of Intelligence as Decision-Support.” Some say there is no such thing as a science of intelligence, and to that challenge we rise. Not only do we believe a science of intelligence has been defined in the past decade, but that it bodes well for decisions in the future because it is above all the science of creating public intelligence in the public interest–intelligence is NOT about secrets for the President; intelligence is about optimizing means, ways, and ends.

E Veritate Potens–From Truth, We the People Are Made Powerful.

See Also:

Journal: Politics & Intelligence–Partners Only When Integrity is Central to BothReference: Lying is Not Patriotic–Ron Paul

Reference: The Fraud-Based US Economy

Reference: Cyber-Intelligence–Restore the Republic Of, By, and For…