Why We're Stuck with a Bubble Economy (December 9, 2013)

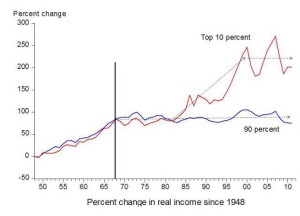

Inflating serial asset bubbles is no substitute for rising real incomes.

Why are we stuck with an economy that only generates serial credit/asset bubbles that crash with catastrophic consequences? Ths answer is actually fairly straightforward.

Let's start with the ideal conditions for an economy that depends on consumer spending.

1. Rising real income, i.e. after adjusting for inflation/currency depreciation, wages/salaries have more purchasing power every year.

2. An expanding pool of new households, i.e. young people who move away from home or graduate from college, get a job and start their own household. New households buy homes, vehicles, furniture, appliances, kitchenware, tools, etc., driving consumption far more than established households.

Neither of these conditions apply to today's economy. Income for the bottom 90% has been stagnant for forty years, and has declined 7% in real terms since 2000.

Read full article with more graphics.

Phi Beta Iota: The US Government was “overthrown” with the assassination of JFK and the cover-up led by LBJ. Thereafter decisions were made on behalf of the 1%, decisions that have resulted in the eradication of the senior blue collar and middle classes that were the engines of prosperity. The USA gets closer every day to a violent revolution focused on concentrated wealth — were the 1% better read, they would know that concentrated wealth and the loss of government legitimacy are the two primary causes of great revolutions across history.

See Especially:

Graphic: Preconditions of Revolution in the USA Today

Graphic: Revolution Model Simplified

See Also:

Matt Taibbi: GRIFTOPIA – RECAP

Review: Griftopia–Bubble Machines, Vampire Squids, and the Long Con That Is Breaking America

Review: The Price of Inequality:How Today’s Divided Society Endangers Our Future

Review: Who Stole the American Dream?

Worth a Look: Book Reviews on Democracy Lost & Found