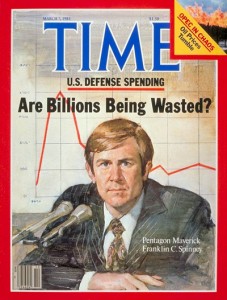

For years I have written about the Defense Power Games — front loading and political engineering — as they are practiced by the Military – Industrial – Congressional Complex. My 1990 pamphlet on this subject was written to explain why the end of the Cold War would not result in a lasting peace dividend — a prediction that has come true to a degree that astonishes me.

As I explained in Section II of the pamphlet, “front loading is the practice of planting seed money for new programs while downplaying their future obligations. This game, which is a clever form of the old-fashioned “bait-and-switch,” makes it easier to sell high-cost programs to skeptics in the Pentagon and Congress. Political engineering is the strategy of spreading dollars, jobs, and profits to as many important congressional districts as possible. By making voters dependent on government money flows, the political engineers put the squeeze on Congress to support the front-loaded program once its true costs become apparent. Front loading and political engineering are about increasing the flow of money; the former starts the money flowing while the latter tries to lock the spigot open, and in American politics, control of the money spigot is power.”

My discussion focused on defense procurement programs, which are by far the most developed and ritualized form of the games , but the central ideas behind these power games — a bait and switch operation to set up an extortion operation — apply to all government taxing and spending programs. In fact front loading and political engineering are now ubiquitous practices that are openly celebrated by cynical political operatives — the fact that they are destroying the idea of using a system of checks and balances to hold the peoples representatives accountable in a democratic republic does not seem to matter. Their effects, for example, can be scene in the corruption federal accounting systems.

To those readers who think I am taking this idea too far, I recommend the attached article, which is a good statement of where the effects of the rug merchant politics shaped by front loading and political engineering power games take us.

Chuck Spinney

Published on Friday, December 3, 2010 by Think Progress

Bush Officials Celebrate Tax Cut ‘Trap’ They Laid Nine Years Ago

by George Zornick

As debate rages in Washington over the Bush tax cuts, set to expire at the end of this year, the Bush administration officials who initiated the steep tax cuts are celebrating what they see as an apparent victory, since signs point to a temporary extension of all the cuts. The Daily Beast’s Howard Kurtz interviewed Dan Bartlett, Bush’s former communications director, and Andy Card, Bush’s former chief of staff, among others, and they were pleased at how the expiration debate has played out:

“We knew that, politically, once you get it into law, it becomes almost impossible to remove it,” says Dan Bartlett, Bush’s former communications director. “That’s not a bad legacy. The fact that we were able to lay the trap does feel pretty good, to tell you the truth.” […]

“[Democrats] are definitely on the defensive,” Card says. “The fact that the 10-year clock ran out now had a big impact on the election.”

As Media Matters notes , former Bush senior adviser Karl Rove went on Fox News this week and further laid the proverbial trap, saying “without a hint of self-awareness” that “we’ve known this was going to be happening for a decade,” while lamenting the Democrats’ inaction.

When the tax cuts were enacted, with an expiration date, Republicans and Bush officials understood the political advantages of the “fiscal time bomb” they were setting. As Kurtz puts it: “At some point in the way distant future, Democrats could be accused of raising taxes if they tried to undo the Bush breaks and return to Clinton-era levels of taxation.” Democrats understood this, too: Sen. Kent Conrad (D-ND) told the Washington Post at the time that “[Bush is] going to be out of office when the roof falls in.”

There was a more sinister motive for sunsetting the tax cuts beyond politics, as well. It allowed the administration to pass the bill with a lower vote count in the Senate than would otherwise be necessary. Card freely admits to Kurtz that the administration wanted “the law to be permanent but couldn’t muster the votes to trump the Byrd Rule,” which would have required a 60-vote margin for a measure that significantly increases the federal deficit more than 10 years in the future. By setting the tax cuts to expire just short of ten years, the measure passed with 58 votes.

The various sunsets also hid the true cost of the bill. As Paul Krugman wrote at the time: “The administration, knowing that its tax cut wouldn’t fit into any responsible budget, pushed through a bill that contains the things it wanted most — big tax cuts for the very, very rich — and used whatever accounting gimmicks it could find to make the overall budget impact seem smaller than it is.”

Such deception and fiscal irresponsibility hardly seem cause for celebration. But because it appears that all of the tax cuts will once again be extended, resetting the fiscal time bomb in spite of public opposition , perhaps these Bush officials are justified in their mirth.