My friend Jeff Madrick, and old fashioned liberal democrat in the best sense of the term, has penned a pithy analysis of the anti-empirical madness now dominating the contemporary American political economy. Jeff concludes that the Right ignores its track record, particularly regarding the clear economic effects of tax cuts, and is rarely challenged on the issue. Madrick is correct. The question is why?

More precisely, why is political debate shaped more by a new dark age of irrational romantic ideology than the by the rationality and empiricism bequeathed to us by the Enlightenment and the Scientific Revolution?

For what it worth, here is my answer: Money. (What follows is my view, and should not be attributed to Jeff.)

Look no further than at a Democratic Party that has sold out, and in so doing, forgot its roots, having grown arrogant, effete, and soft in the comfortable aftermath of its dominance under Roosevelt, Truman, and Johnson, each of whom, whatever his faults, was at least a fighter. The real problem corrupting our warped politics has less to do with the Right Wing Wrecking Crew than with the rise of wimpish neo-liberal and pro-defense Democrats (e.g., like Presidents Carter, Clinton, and Obama), who are now being reinforced by the so-called progressives, who are willing to go along with Obama's strategy of appeasing the right wing wreckers, rationalizing that any alternative to Obama will be worse. A more reliable pathway to strategic defeat is hard to imagine. Maybe the wrecking crew's winner-take-all politics of fang and claw ought to be answered by a more principled politics of fang an claw.

Appeasement of the winner-take-all neo-fascist ambitions of the Right Wing Wrecking Crew is clearly a political strategy that can not work. In fact, feeding this monster increases its voracity.

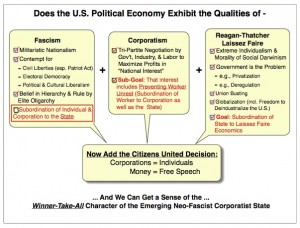

Some people might bridle at my introduction of the adjective ‘neo-fascist,' but I am using the term advisedly. The attached chart depicts the generally accepted characteristics of Fascism, Corporatism, and extreme Laissez Faire Capitalism. Note that classically accepted characterizations of Fascism includes not only subordination of the individual, but also the corporation to the State. The latter is clearly not the case in the current American political economy – hence the modifier neo-fascist. But the rest of “checked” boxes are all present, at least in some significant degree. Moreover, the emergent properties of this neo-fascist corporatist state were just reinforced powerfully by the Citizens United decision of the Supreme Court — a decision that equated corporations to people and money to free speech. For readers who are unsettled by this characterization, ask yourselves if what you have to assume to uncheck enough boxes in the figure below to undo the conclusion.

For a penetrating analysis of what has happened to our politics over the last thirty years and why this is so, read Winner-Take-All Politics: How Washington Made the Rich Richer — And Turned Its Back on the Middle Class, by Jacob Hacker and Paul Pierson (Simon & Shuster: New York 2010) — and think about what it will take to undo this mess. This brings us back to facing up to the politics of fighting this evolution in lieu of continuing the strategy of appeasement.

For a penetrating analysis of what has happened to our politics over the last thirty years and why this is so, read Winner-Take-All Politics: How Washington Made the Rich Richer — And Turned Its Back on the Middle Class, by Jacob Hacker and Paul Pierson (Simon & Shuster: New York 2010) — and think about what it will take to undo this mess. This brings us back to facing up to the politics of fighting this evolution in lieu of continuing the strategy of appeasement.

Chuck Spinney

Barcelona

Budget Fallacies: Why the Ryan Plan Won’t Work

Jeff Madrick, The New York Review of Books, 4/19/11 2:00 PM

Center on Budget and Policy Priorities | cbpp.org

Among the economic fallacies embraced in Congressman Paul Ryan’s budget proposal, two are particularly egregious:

- that getting rid of Medicare will reduce health care costs and

- that enacting yet further tax cuts for the rich will spur growth and investment.

Critics on the left are up in arms because Ryan’s proposal to force Medicare recipients to buy private insurance will raise the amount those now under 55 will pay when they are old enough to get Medicare by an average of $6,000 a person. In other words, critics say, we are trying to cut health care costs—and supposedly reform it through more privatization—on the backs of future elderly Medicare recipients.

But the Ryan plan won’t reduce health care costs. As Peter Orszag, the former White House budget director, told me recently, the bipartisan Congressional Budget Office calculates that overall health care spending will go up as Medicare recipients are forced to buy private insurance, since private insurance has far higher administrative expenses than Medicare. Health care expenditures, as Orszag nicely puts it, are not being reduced on the backs of seniors, they are being raised on the backs of seniors.

And herein lies a further misunderstanding. It is true that the main cause of long-term budget deficits today is the expected rapid rise in expenditures for health insurance programs like Medicare and Medicaid (not Social Security, though they are all too often lumped together in the press). But the main reason those programs will become so costly is the rapid expected increase in health care costs in general, not the purported over-generosity of Medicare and Medicaid.

All effort should go into reforming health care. Americans pay far more per person in health care for outcomes that are typically not as good as in many nations that spend far less. In my view, effective health care reform will require much more serious government involvement—certainly not less—in improving efficiency and reducing costs.

As for the tax-cut mantra that it will automatically raise rates of growth, it is hard to believe that this theory has any credibility after the poor performance of the economy since the Bush tax cuts. Yet the Ryan plan would not only retain the Bush cuts for those who earn more than $250,000 a year; it would increase the cut for those who make more. This is in the tradition of Ronald Reagan, who spearheaded the sharp reduction in progressive income taxes as soon as he got into office, but helped reduce the enormous budget deficit that generated by supporting, with the help of Democrats, the regressive increase in payroll taxes for Social Security. That increase was supposed to be used to make Social Security financially secure in the future, but the excess money went to pay current budget expenditures instead. All the while, Reagan never produced more rapid productivity growth as promised—the output per hour of work, which is the source of prosperity. And budget deficits did not fall below roughly 3 percent of Gross Domestic Product, the national income.

It is time for the press, which has barely noticed how slow growth was under George W. Bush, to start pounding on this theme. Since the bottom of the 2001 recession to the top of the expansion in 2007—before the credit crisis and Great Recession!—GDP discounted for inflation grew more slowly than during any expansion in post-World War II history. Job growth was even worse, way behind any expansion in the last 65 years. Below are the data, prepared by the Economic Cycle Research Institute.

|

Expansion

(bottom to top)

|

Annual rate of

Real GDP Growth

|

Annual rate of

Job Growth

|

|

1949–53

|

7.5

|

4.4

|

|

1954–57

|

4.0

|

2.5

|

|

1958–60

|

5.7

|

3.6

|

|

1961–69

|

4.8

|

3.3

|

|

1970–73

|

5.2

|

3.4

|

|

1975–80

|

4.3

|

3.6

|

|

1980–81

|

4.4

|

2.0

|

|

1982–90

|

4.2

|

2.8

|

|

1991–2001

|

3.6

|

2.0

|

|

After Bush tax cuts

|

||

|

2001–07

|

2.7

|

0.9

|

Meantime, family income did abysmally in the same period, remaining below the highs it reached, discounted for inflation, in 1999. Failing to exceed former highs probably never happened before in a long expansion. But most disturbing, even capital investment grew unusually slow in this period where tax cuts were supposed to create incentives for wealthy people to take entrepreneurial risk. As profits rose, capital investment grew more slowly than in all but one economic expansion.

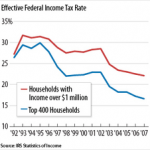

The right effectively ignores the record of the Bush tax cuts, and in my reading is rarely challenged on the issue. Yet recent history makes a powerful case against tax cuts. If the Ryan plan were passed, two thirds of alleged savings would be taken out of the hides of what the Center on Budget and Policy Priorities calls people of “modest means.” Sharp cuts would be made not only to Medicare and Medicaid, but also to infrastructure spending and funds for Pell Grants for college tuition—both areas that are crucial to the nation’s long term economic performance. In sum, poverty will rise and public investment in the economy’s foundation will founder, while people with an annual income of more than $1 million a year will get a tax cut of $125,000 a year. Does any rational person think this is a sound approach to our future?

Phi Beta Iota: Even this excellent analysis is severely flawed for two reasons: first, it lacks intelligence (decision-support) about WHY Medicare is so expensive. Medicare is expensive because a corrupt US Congress mandated that the Executive pay the prices demanded by the pharmaceuticals (without negotiation), instead of the prices paid everywhere else (eg Brazil, South Africa, Thailand). We can reduce Medicare cost to 1% (ONE percent) of what have in the budget simply by introducing integrity and intelligence in the management of that program. The Ryan plan is willfully dishonest. Any plan that does not call for the immediate cessation of government borrowing in our name ($1 trillion a year, one third of the bloated and very corrupt federal budget) is dishonest. Any plan that does not call for the elimination of personal income taxes and the introduction of the Automated Payment Transaction (APT) Tax is ignorant. The US Government lacks intelligence and integrity. This is the fundamental problem that needs to be corrected, everything else is a detail. Electoral Reform (1 page, 9 points) addresses the real problem. There is nothing wrong with America that cannot be rapidly corrected by restoring the sovereign common sense of the citizens as a whole. The corruption of the rich is secondary–a failed government made that possible. The failure of government across all twelve core policies, its failure against all ten high-level threats to humanity, and its oblivion to the urgency of respecting the fundamental needs of the eight demographics, can also be traced to the lack of intelligence & integrity in government–in meta-terms, naturally.

See Also:

Seven Promises to America–Who Will Do This?

Obama in a Strategic & Intellectual Vacuum

Serious (Honest) Thinking About US Budget

US Goverment 2011 Revenue, Costs, & Debt–Two Party Tyranny Lies Straight Up, Media Goes Along

Four Time Bombs Centered on Wall Street

Why Isn’t Wall Street in Jail? + US Fraud RECAP

Review: Griftopia–Bubble Machines, Vampire Squids, and the Long Con That Is Breaking America