Prof. Stiglitz is a Nobel Laureate, former Chief Economist of the World Bank and former head of the Council of Economic Advisors to President Clinton.

Related:

Prof. Stiglitz is a Nobel Laureate, former Chief Economist of the World Bank and former head of the Council of Economic Advisors to President Clinton.

Related:

One of the probable spinoffs of America's disastrous “you are with us or against us” unilateralism in Iraq, Afghanistan, Pakistan, Yemen, Iran, etc., is a loss of our moral authority to lead other nations into supporting our adventures. In this regard, the future of Nato is the big question mark. This question can not be separated from the internal stress now endangering the future of EU. The attached op-ed by William Pfaff, a euro-centered, American writer, provides an interesting perspective on these questions. CS

What Next for NATO?

Posted By William Pfaff On May 18, 2010 @ 11:00 pm

The European Union doesn’t know where it stands at this moment. NATO thinks it knows and is gambling.

http://original.antiwar.com/pfaff/2010/05/18/what-next-for-nato/print/

My good friend Robert Bryce tries to inject a little truth into a green technology known as Carbon Capture. He is author of several energy-related books, including the the book shown below.

My good friend Robert Bryce tries to inject a little truth into a green technology known as Carbon Capture. He is author of several energy-related books, including the the book shown below.

May 12, 2010

A Bad Bet on Carbon

By ROBERT BRYCE

On Wednesday John Kerry and Joseph Lieberman introduced their long-awaited Senate energy bill, which includes incentives of $2 billion per year for carbon capture and sequestration, the technology that removes carbon dioxide from the smokestack at power plants and forces it into underground storage. This significant allocation would come on top of the $2.4 billion for carbon capture projects that appeared in last year’s stimulus package.

Washington

That’s a lot of money for a technology whose adoption faces three potentially insurmountable hurdles: it greatly reduces the output of power plants; pipeline capacity to move the newly captured carbon dioxide is woefully insufficient; and the volume of waste material is staggering. Lawmakers should stop perpetuating the hope that the technology can help make huge cuts in the United States’ carbon dioxide emissions.

READ REST OF ARTICLE

http://www.nytimes.com/2010/05/13/opinion/13bryce.html

See also, by the same author:

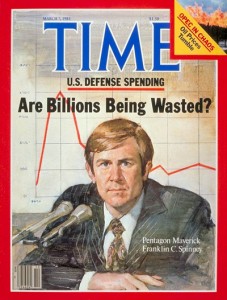

By FRANKLIN C. SPINNEY

Nisos Kos, Greece

In the 11 May issue of CounterPunch, apparently based on White House and Pentagon sources, Gareth Porter, one of the most able journalists covering the Afghan debacle, reported that General McChrystal’s war plan is in the early stages of unravelling. To appreciate why this was entirely predictable, consider please, the following:

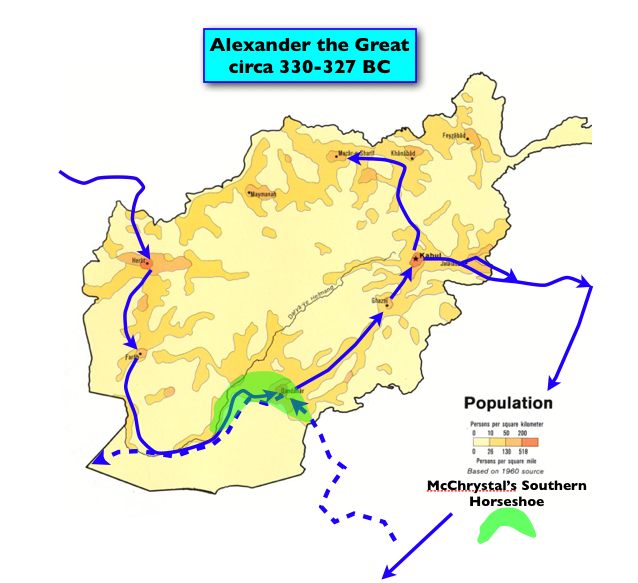

On January 2, during an interview with Drew Brown of Stars and Stripes, McChrystal described his plan to create an ‘arc of security’ in the most densely populated regions of Southern Afghanistan. The green shaded area in the following map of Afghanistan overlays McChystal’s arc on the distribution of population densities. I constructed it from the information contained in Brown’s interview. As you can see, McChrystal plan opens his biggest military campaign to date by invading a region that has seen many invasions and much fighting during the last two thousand years, including operations by Alexander the Great (also shown on the chart), both of the 19th Century Anglo-Afghan Wars, and the Soviet-Afghan War of the 1980s.

Historically minded tribal cultures, like the Pashtun, have had plenty of time to learn and remember the strengths and weaknesses of this terrain by resisting these invaders using the timeless arts of guerrilla war. Note, for example, the stunning similarity of Alexander the Great’s invasion route in the figure to that of the Soviet’s shown here.

McChrystal’s first move in implementing his pacification strategy was to invade Marjah (which is in the western part of the shaded area) in mid February. The aim of this operation was a variation of Marshall Lyautey’s ink spot theory: namely to clear the Taliban out of Marjah, secure the area, and prevent the return of the Taliban. Success in this operation would set the stage spreading the area of pacification by clearing the Taliban out of the more populated city of Qandahar. And so, moving from west to east along Alexander’s (and the Soviet’s) route, the ink spot would spread to Qandahar in the eastern part of the arc.

Without being critical, I note that neither Porter nor his sources mention the role of Afghan army and police forces in the unravelling of McChrystal’s plan. Porter is certainly aware of these limitations, having written several important reports on this subject. Nevertheless, the implication of the Taliban re-infiltration of the Marjah region is clear: the Afghan security forces in the region are either insufficient or ineffective (or both) to perform their job of protecting the people by permanently cleansing the area of Taliban.

The inability to spread the “ink spot” McChrystal tried to insert with the Marjah offensive has its roots in the central flaw highlighted last September in my critique of McChrystal’s escalation plan, which was submitted to President Obama last summer. This inability also means that US forces will be needed to provide security to the Marjah region, if McChrystal sticks to his strategic aim. This requirement, which would have been easily foreseen, had McChrystal presented Mr. Obama with a straightforward assessment of the very limited capabilities of the Afghan security forces, will now result in our forces being spread out to protect this region, assuming we want to protect the Marjah “ink spot.” The deployment of US pacification troops will probably take the form of an array of strong points and outposts, backed up with quick reaction reinforcements, kept on alert in nearby bases, together with airpower.

If our troops are being deployed this way, they will be unavailable for the upcoming Qandahar offensive. Moreover, they will become vulnerable to being attacked piecemeal in a series of irregular, but frequent hit and run attacks on bases and supply routes. This kind of rope-a-dope strategy will keep our troops on edge and put them under continual mental and physical stress — and they will be vulnerable to being ground down much like the British troops were last summer. The continuing pressure will naturally increase the jumpiness of our soldiers and marines and, if past is prologue, will likely increase their trigger-happiness, including more calls for artillery and air support. More firepower means more civilian deaths in the “pacified” region, and the rising bloodshed will play into the Taliban’s hands by alienating the hearts and minds of local population we claim to be protecting, a process which is already in progress.

This hydra of emerging pressures, which is probably just beginning to be appreciated, is probably why the looming offensive to secure Qandahar that McChrystal was broadcasting in April is now being scaled back in its aims.

Later this summer, as these problems become more apparent and American mid-term elections loom, we can expect to be subjected to a unseemly spectacle finger pointing and a search for scapegoats. In the end, the debacle will be fault of Obama and by extension the Democrat’s, because the President ignored Sun Tzu’s timeless wisdom, when he approved McChrystal’s fatally flawed plan, despite the cabled warnings of retired Army general Karl Eikenberry, his ambassador to Afghanistan.

Franklin “Chuck” Spinney is a former military analyst for the Pentagon. He currently lives on a sailboat in the Mediterranean and can be reached at chuck_spinney@mac.com

Posted on May 11, 2010

By William Pfaff

The obituaries written of the European currency, the euro, have demonstrated divergences in national and cultural temperaments, the European funereal and laden with gloom about the future, but unyielding, and the American and British cheerfully and self-satisfiedly shoveling earth onto a casket of euros already six feet into the ground. Defy the markets, will they, these Europeans! Suddenly, the lid of the casket flew open early Monday morning, and the euro burst forth, bigger, better and brighter than before!

Sunday night, German Chancellor Angela Merkel was prudently off in Moscow to watch a V-E Day parade in Red Square, rather than witness electoral humiliation in North Rhine-Westphalia (where her party lost because of voter resentment of pleasure-loving Greeks squandering German wealth amidst permanent sunshine!). Britain was politically decapitated, without a functioning government.

Before Merkel was back, the German government had run up the white flag. The euro crisis was over. If any individual was a winner, it was temperamental and widely derided French President Nicolas Sarkozy, who has insisted since his election in 2007 that Europe (or the euro’s users) requires a politically sophisticated decision-making authority.

Continue reading “Journal: Euro’s Crisis Has American Fingerprints”

EuroZone All In

By Peter Boone and Simon Johnson, Baseline Scenario, 10 May 2010

The eurozone self-rescue plan announced last night has three main elements:

At first pass this package might seem to be in with what we recommended

But the European central banks have come in very early – with government bond prices still high – and there is no sign yet of credible fiscal adjustment for Spain and Portugal. The eurozone apparently did not even discuss the situation in Ireland, which seems increasingly troubling.

This is a whole new level of global moral hazard – the result of an alliance of convenience between troubled governments in the south of Europe and the north European banks (and implicitly, north American banks) who enabled their debt habit. The Europeans promise to unveil a mechanism this week that will “prevent abuse” by borrowing countries, but it is hard to see how this would really work in Europe today.

Overall, this is our assessment:

The underlying problem in the euro zone is that Portugal, Ireland, Italy, Greece, and Spain are locked into a currency which means they are uncompetitive in trade terms while they are also running large budget deficits. To get out of this they need large wage and price cuts to restore competitiveness, and they need to make fiscal cuts to get budget balances back at sustainable levels.

Markets decided these adjustments were going to be difficult, so spreads on those countries’ debts widened (i.e., interest rates relative to German government bonds). As the rates go up, this causes local asset prices to fall, concerns over bank balance sheets increase, etc. This combination was causing an incipient run on banks. Any country with its own currency could reasonably devalue in such a situation, but this is not an option within the euro bloc.

All these problems were exacerbated by the appearance that the Germans were going to be unwilling to bail out troubled nations – and would eventually chose to bail out their own banks instead. It is this risk which is now resolved. The Germans have shown willingness to provide very large amounts of money (the 750bn euro support is probably just enough for Spain and Portugal if they got packages in line with that received by Greece) and they would obviously provide more if needed (e.g., for Italy). (Here again is the ready reckoning chart for

However, the solvency issue remains. The Spanish and Portuguese have said they will now cut their budgets further, but already their forecasts were optimistic, and neither has seemed willing to admit they have severe budget problems, so we will need to watch how they implement in the near term. Greece

750bn euros in a fiscal support program, with 1/3 coming from the IMF (although this was apparently news to the IMF).The European Central Bank promises to buy bonds in dysfunctional markets.Swap lines with the Federal Reserve, to provide dollars.a week ago and again on Thursday.interlinkages between indebted Europeans.)remains simply far too indebted.

READ MORE:

What happened to the global economy and what we can do about it

By Simon Johnson, 13 Bankers: The Wall Street Takeover and The Next Financial Meltdown

The bank lobbyists have the champagne out – the Brown-Kaufman amendment, which would have capped the size and leverage of our largest banks – was defeated in the Senate last night, 33-61. Feeling ascendant, the big banks swarm forward to take on their next foe – the Kanjorski amendment (that would greatly strengthen the power of regulators to break up megabanks), which they plan to gut in the backrooms.

This is overconfidence – because the consensus against them is beginning to shift significantly. Partly this is the result of great efforts by Senator Ted Kaufman, Senator Sherrod Brown, and their colleagues over recent months and weeks. Partly this is due to all the people who came on board and pushed hard.

But, as in many such cases, it is also a question of luck – and timing.

The European sovereign debt crisis is deepening. And the picture that is worth many thousands of words is the NYT’s graph of interlocking debt within the eurozone.

As far as anyone can ascertain, this is almost all debt held by banks (often then “repo-ing”, or borrowing against it as collateral, at the European Central Bank.)

In other words, the European megabanks – lauded by Senators Dodd, Corker, Warner and others as a model for us to follow – are up to the eyeballs in bad debt. Their governance has completely failed. Their regulatory systems have been gutted – on their way to being turned into ash.

None of this would matter, of course, if the eurozone policy elite had its act together and could terminate its current position with minimal losses. But it cannot – the deer are in the headlights.

Ask everyone this question: Which are the huge global banks that Senator Dodd, Jamie Dimon, and Larry Summers think we should be emulating? Surely not the Chinese – their governance failures are profound and complete; this is state banking run amok. Surely not the British – after all Mervyn King and Adair Turner, the top authorities on those banks, are globally the most articulate officials on how good finance has gone so deeply wrong. Surely not the Canadians – those myths have been long exploded (and without dissent, in our conversations with the Bank of Canada).

And surely you are not proposing that the continental European banks are a model of anything other than ineptness, blind herding, and the transition from being “too big to fail” to “so big that even when you save them, you get an economic catastrophe”?

To the victors last night in the Senate: congratulations – your opponents have fallen back. Your generals are known to be invincible, your forces are the best, and your resources are without limit.

And so we wait for you again, on a gentle slope and behind a ridge – appropriately enough with our backs to Brussels. Welcome to Waterloo.