In the coming months, we are going to be inundated by the rhetoric surrounding an economic policy debate over the question of whether or not the Federal Government ought to begin to reduce the fiscal imbalances in its budget. The ideology of Joseph Schumpeter's Creative Destruction will be pitted against ideology of John Maynard Keynes, and the dominant issue will be the question of retrenchment: Should the Federal Government retrench? … or .. Will consumers and businesses continue to retrench?

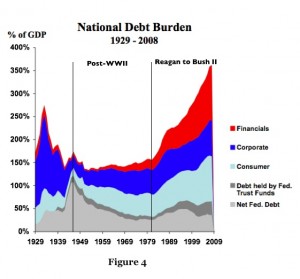

The chart, which I have used before. It portrays the buildup of debt as a percentage of GDP for the different categories indebtedness that are at the center of the retrenchment question. All of the data from 1946 forward was compiled by the Federal Reserve. Earlier data is from a mixture of sources including the Census, Fed, GAO, and Morgan Stanley. I believe , it shows why some kind of retrenchment is now inevitable.

The chart, which I have used before. It portrays the buildup of debt as a percentage of GDP for the different categories indebtedness that are at the center of the retrenchment question. All of the data from 1946 forward was compiled by the Federal Reserve. Earlier data is from a mixture of sources including the Census, Fed, GAO, and Morgan Stanley. I believe , it shows why some kind of retrenchment is now inevitable.

Although most economists and policy makers like to think of an economic system in mechanistic terms, the economy is in fact an unpredictable living thing made up of millions of players who move forward on a one-way trip through time along a pathway shaped by an interplay between chance and necessity. In this sense, you can think of the figure above is an outward manifestation of the historical behaviour of a complex living organism. When we hear pundits speak of the interplay of fear and greed, Greenspan's “irrational exuberance, or Keynes' “animal spirits” they are talking about the living aspects of this system (to which they immediately slip backward in to applying mechanistic diagnostics). When they do so, they forget that all living systems are complex open systems that use an ever-changing homeostatic mix of positive and negative feedback loops to maintain stability, while they maintain their structure by feeding on and expelling waste into their environment. When these internal control loops get out of balance, the homeostatic regulating system breaks down, and the entire organism goes out of control in a form of runaway behavior, like cancer cells in living tissue.

I think the figure suggests that the recent crisis could the the result of such a breakdown: Note, that after being relatively stable in the post WWII period, the total debt in the economy went unstable in 1981 and exploded into a rapid buildup of growth, most of which took place in the private, supposedly self-regulating sector. The causes of this instability are complex and not understood in my opinion, but the chart makes it quite clear that some kind of amplification via multiple positive and negative feedback effects combined a nonlinear way to trigger a runaway situation that exploded in 1981(no doubt some of the triggers were in place and building up before that). It is also clear from our knowledge of non-linear chaotic systems that such a situation could not continue forever — which brings us to central questions of retrenchment: Who should retrench? And how much is enough?

Of course no one has a clue about the answer to either question, but the battle has been joined.

One side of the debate will posit that the economic growth is returning and we are entering a recovery that could be stifled by the inflationary impact of horrendous federal deficits, which resulted primarily from by

[1] the recession-related effects of reduced tax intake and increased spending for stabilizers like unemployment insurance;

[2] the Obama stimulus plan; and

[3], the bailouts of the financial sector.

Put simply, this boils down to the argument championed by the Chicago/Austrian School, namely the economy has turned the corner, the weak have been pruned out of the system, and business is leaner and meaner, banks have been bailed out and prepared to lend, and therefore, it is best for government to get out of the way and let the free market work its creative magic out of the recent destruction — that is to say, we dodged the bullet and we can go back to business as usual, and to do so, the federal government must retrench. A good example of this point of view can be found at the Peter Peterson foundation and its citizen's guide our government's finances

On the other side of the debate is the Keynesian argument that government is the only sector that pump up the demand needed to place the economy onto a long term pathway to sustainable growth. At the heart of this argument is the contention that [1] consumer spending, which is about 70% or the economy, will remain sluggish as consumers continue to retrench because of the negative wealth effect brought about by the housing collapse and excessive indebtedness; [2] business investment will at best be sluggish, because weak consumer demand high business indebtedness will cause the business sector to continue its retrenchment; and [3], given the American economy's non competitiveness in international trade, it is inconceivable that the American economy can generate enough exports in the near term to make up for the depressing effects of sluggish consumer demand and business investment. Therefore, the only game in town is to stimulate demand by more deficit spending. In essence, this argument says the private sector will continue to retrench, and so the federal government must continue and increase its stimulus. The recent op-ed, “That 1937 Feeling” by Paul Krugman is an excellent summary of this argument.

One subject that will be missing from each side of this argument during 2010 will be an analysis of the economic effects of the unprecedented levels of defense spending, which is now higher in inflation-adjusted terms than at any time during the cold war and is equal to the rest of the world combined. In particular,we won't hear any discussion of the massive long term opportunity costs of the distortionary and productivity-reducing effects of defense spending, like those described by my friend, the late Professor Seymour Melman, in his prophetically important book “Profits Without Production” (Knopf 1983, out of print but available in used book market). Nor will we hear discussions about the economic effects of the near them opportunity costs posed by the fact that the US is now hemorrhaging huge amounts of money overseas in two wars in an endless long war on terror that, with the recent focus on Yemen, is beginning to resemble the carnival game of “whack a mole.” If defense spending was good for the economy, and many claim, the United States would be the most export competitive country in the world rather than the worlds largest importer of manufactured goods.

Chuck