It looks increasingly likely that President Obama is going to cave into the oil interests promoting the pipeline to move oil mine in tar sands of Canada to the Port Arthur Free Trade Zone in Texas.

One of the prime selling points of this scheme, which has environmentalists all in uproar will no doubt be that the pipeline is needed for energy security. So what is going on? My good friend Pierre Sprey's answer may surprise you. He has graciously given me permission to distribute it.

Peak Oil or Peak Profits?

email from Pierre Sprey, 5 September 2005

A new Oil Change International report has injected a breath of fresh air into the endless stream of media BS about peak oil, declining US oil production, disastrous dependence on foreign oil, need for new offshore drilling, blah, blah , blah, blah…. The report's charts show that our domestic oil production has been rising markedly since 2008. The excess domestic oil and the new Keystone pipeline oil are unneeded for the domestic market and will go largely to exports to fatten Big Oil's bottom line.

The most interesting conclusions are:

- “Gasoline demand is declining due to increasing vehicle efficiency and slow economic growth;

- Meanwhile the surge in new shale oil production in North Dakota and Texas has led to the first rise in U.S. oil production since 1970 and is forecast to continue for some time;

- As a result of stagnant demand and the rise in both domestic and Canadian oil production, there is a glut of oil in the U.S. market.

Refiners have therefore identified export markets as their primary hope for growth and maximum profits.

The shale surge and the glut of oil is driving the oil industry to adapt America’s petroleum transportation structure to a completely new reality: oil and fuel moving from the heartland to the coasts, instead of the other way round. Globally, the state of the oil products market is also important to look at in understanding the attraction of U.S. refiners to export. Consider:

- There is a shortage of diesel capacity in global refining thanks to high demand in Europe and developing countries;

- There is a long term shortage of refining capacity in Latin America;

- As a result gulf coast refiners have been increasing exports of diesel to Europe and Latin America;

- These structural dynamics are forecast by the EIA to be long term;”

The three key graphs supporting these devastating conclusions are on pages 3 and 4 of the report, with full references in the appendix and are reproduced below. (I do urge you to download the report and read it, it is only 12 devastating pages)

“Valero’s [the refiner] strategy is to exploit arbitrage in the Atlantic basin, selling gasoline into the U.S. market while exporting diesel to Europe and both diesel and gasoline into Latin America.

The idea that Keystone XL enhances U.S. energy security is undermined by Valero’s business model that seeks to export products made with imported oil while further importing gasoline from a third country.

Not only is Valero increasing U.S. imports of oil and gasoline, but it will also avoid paying tax while doing so. The Port Arthur refinery operates as a Foreign Trade Zone (FTZ), which traditionally gives tax benefits to companies that use imported com- ponents to manufacture items within the United States.27 Usually refineries importing oil tax-free will still pay taxes when selling the refined products into the U.S. market. By both importing into and export-ing from Port Arthur the company will avoid paying tax on the product sales.”

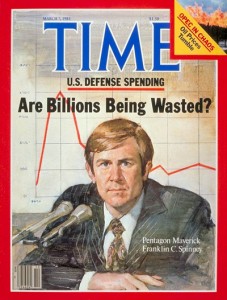

Chuck Spinney

Isles d'Hyeres, France

Phi Beta Iota: This is representative of the kind of truth-telling that would be the foundation for public intelligence in the public interest. This kind of knowledge is ably discussed in Review: Fog Facts –Searching for Truth in the Land of Spin (Nation Books) (Hardcover).

See Also:

Worth a Look: Book Reviews on Disinformation, Other Information Pathologies, & Repression