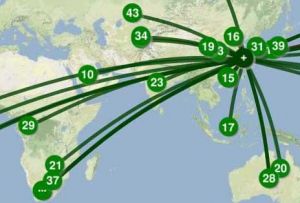

Sourcemap is a platform that enables users to contribute to and share ideas about sustainability. Whether you are inviting people to an event, buying ingredients for a recipe, or designing a product, your choices have a significant impact. Some decisions have impacts that stretch across the world, whereas others are entirely regional. Understanding the reach of our actions and facilitating positive change is fundamental to improving economic, social, and environmental conditions.

With a tip of the hat toleonardo bonanni doctoral candidate at the MIT Media Lab, a designer and an artist. He teaches the MIT class Future Craft: Radical Sustainability in Product Design on the social aspects of mass design. You can also find his blog, photos, and videos. To find out more and for contact information, download his resume.

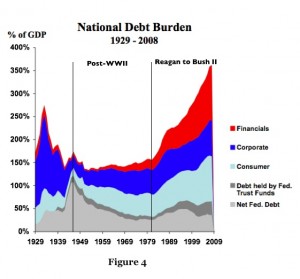

The chart, which I have used before. It portrays the buildup of debt as a percentage of GDP for the different categories indebtedness that are at the center of the retrenchment question. All of the data from 1946 forward was compiled by the Federal Reserve. Earlier data is from a mixture of sources including the Census, Fed, GAO, and Morgan Stanley. I believe , it shows why some kind of retrenchment is now inevitable.

The chart, which I have used before. It portrays the buildup of debt as a percentage of GDP for the different categories indebtedness that are at the center of the retrenchment question. All of the data from 1946 forward was compiled by the Federal Reserve. Earlier data is from a mixture of sources including the Census, Fed, GAO, and Morgan Stanley. I believe , it shows why some kind of retrenchment is now inevitable.