http://tom-atlee.posterous.

Short URL: http://post.ly/83Ojt

Dear friends,

I'm interested in derivatives as a symbol of an economic system that's NOT based on productivity that satisfies real human needs. Derivatives are contracts that shift risk from players who are risk averse (and want insurance against loss) to players who have an appetite for risk (and want a big gambling win).* While originally intended to serve much like an insurance policy, they have turned into a tool for high-stakes gambling that puts everyone else at risk.

The speculative market in financial derivatives is – depending on whose estimate you read – THREE to TWENTY (or more) times bigger than the whole global economy – way bigger than the GDP of the entire world. Derivatives are a very big part of what is called “the casino economy”. Financial speculation is basically gambling that the value of something – commodities, stocks, currency, whatever – will go up or down. The casino economy is not about producing or financing real goods or services.* It is about making lots of money for the successful gamblers.

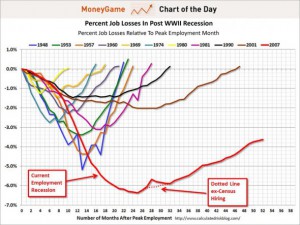

The rest of us could let them go ahead and gamble except for two things. First, many of them use the money they get to buy more influence and power, making a mockery of “the free market” and “democratic self-governance”. Secondly, the wrong sequence of bad guesses, responses and glitches in this highly computerized money-making game could wipe out the global economy that the rest of us depend on. We are still stumbling from the last global financial crash in 2008 – in which derivatives played a major role. But far bigger crashes are possible.

Continue reading “Tom Atlee: Derivatives as Fatal Cancer Discussion and Links”