On 12 December, I described a concatenation of warmongering pressures that were shaping the popular psyche in favor of bombing Iran. Now, in a 21 December essay [also attached below], Steven Walt describes a further escalation of these pressures — in this case, via the profoundly flawed pro-bombing analysis, Time to Attack Iran: Why a Strike is the Least Bad Option, penned by Matthew Kroenig in January/February 2012 issue of the influential journal Foreign Affairs.

One would think that our recent experiences in Iraq and Afghanistan and our growing strategic problems in Pakistan, not to mention our economic problems and political paralysis at home, would temper our enthusiasm for launching yet another so-called preventative war. But that is not the case, as Kroenig's analysis and the growing anti-Iran hysteria in the debates among the the Republican running for president show (Ron Paul excepted) show. Moreover, President Obama’s Clintonesque efforts to triangulate the pro-war political pressures of the Republicans, while appeasing the Israelis, may be smart domestic politics in the short term, but they add fuel to the pro-war fires shaping the popular psyche. Finally, as I wrote last January, lurking beneath the fiery anti-Iran rhetoric are more deeply rooted domestic political-economic reasons for promoting perpetual war — reasons that have more to do with sustaining the money flowing into the Military – Industrial – Congressional Complex in the post-Cold War era than in shaping a foreign policy based on national interests.

While it is easy to whip up popular enthusiasm for launching a new war, our misadventures in Iraq and Afghanistan have shown that successfully prosecuting wars of choice are quite another matter. Nevertheless, as my good friend Mike Lofgren explains in his recent essay, Propagandizing for Perpetual War, devastating rebuttals like Walt's are likely to have little effect on the course of events.

One final point … a surprise attack on Iran would trigger a far tougher war to prosecute successfully that either Iraq or Afghanistan. If you doubt this, I suggest you study Anthony Cordesman’s 2009 analysis of the operational problems confronting Israel, should it decide to launch a surprise attack on Iran’s nuclear facilities.

Yet, the beat goes on.

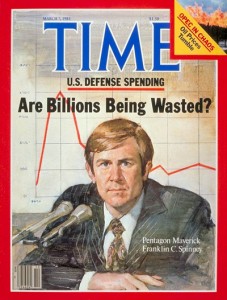

Chuck Spinney

The Blaster

The worst case for war with Iran

Stephen M. Walt

Foreign Policy, 22 December 2011

If you'd like to read a textbook example of war-mongering disguised as “analysis,” I recommend Matthew Kroenig's forthcoming article in Foreign Affairs, titled “Time to Attack Iran: Why a Strike Is the Least Bad Option.” It is a remarkably poor piece of advocacy, all the more surprising because Kroenig is a smart scholar who has done some good work in the past. It makes one wonder if there's something peculiar in the D.C. water supply.

There is a simple and time-honored formula for making the case for war, especially preventive war. First, you portray the supposed threat as dire and growing, and then try to convince people that if we don't act now, horrible things will happen down the road. (Remember Condi Rice's infamous warnings about Saddam's “mushroom cloud”?) All this step requires is a bit of imagination and a willingness to assume the worst. Second, you have to persuade readers that the costs and risks of going to war aren't that great. If you want to sound sophisticated and balanced, you acknowledge that there are counterarguments and risks involved. But then you do your best to shoot down the objections and emphasize all the ways that those risks can be minimized. In short: In Step 1 you adopt a relentlessly gloomy view of the consequences of inaction; in Step 2 you switch to bulletproof optimism about how the war will play out.

Kroenig's piece follows this blueprint perfectly.