Widgets for GAO Reports and Legal Decisions

General Accountability OfficePaul Craig Roberts: Collapse at Hand – and ONE THING an Honest Government Could Do To Make It All Right

03 Economy, 07 Other Atrocities, 09 Justice, 10 Transnational Crime, 11 Society, Blog Wisdom, Budgets & Funding, Commerce, Commercial Intelligence, Corruption, Cultural Intelligence, General Accountability Office, Government, Law Enforcement, Money, Banks & Concentrated Wealth, Office of Management and Budget

Collapse At Hand

Ever since the beginning of the financial crisis and quantitative easing, the question has been before us: How can the Federal Reserve maintain zero interest rates for banks and negative real interest rates for savers and bond holders when the US government is adding $1.5 trillion to the national debt every year via its budget deficits? Not long ago the Fed announced that it was going to continue this policy for another 2 or 3 years. Indeed, the Fed is locked into the policy. Without the artificially low interest rates, the debt service on the national debt would be so large that it would raise questions about the US Treasury’s credit rating and the viability of the dollar, and the trillions of dollars in Interest Rate Swaps and other derivatives would come unglued.

In other words, financial deregulation leading to Wall Street’s gambles, the US government’s decision to bail out the banks and to keep them afloat, and the Federal Reserve’s zero interest rate policy have put the economic future of the US and its currency in an untenable and dangerous position. It will not be possible to continue to flood the bond markets with $1.5 trillion in new issues each year when the interest rate on the bonds is less than the rate of inflation. Everyone who purchases a Treasury bond is purchasing a depreciating asset. Moreover, the capital risk of investing in Treasuries is very high. The low interest rate means that the price paid for the bond is very high. A rise in interest rates, which must come sooner or later, will collapse the price of the bonds and inflict capital losses on bond holders, both domestic and foreign.

The question is: when is sooner or later? The purpose of this article is to examine that question.

Eagle: 100 Million Americans Without Jobs

01 Poverty, 03 Economy, 07 Other Atrocities, 09 Justice, 11 Society, Commerce, Corruption, General Accountability Office, Government, Office of Management and Budget

100 Million Americans Without Jobs

by Gekko

The national unemployment rate gets lots of attention, and lately more attention has been paid to the workforce participation rate since more Americans have given up looking for a job, but we can also see that an astounding 100 million Americans don’t have jobs.

Specifically, these are people who are part of the civilian over-16 non-institutional population who are either unemployed or not part of the workforce. According to the April jobs report, the number of jobless American stood at 100.9 million.

Specifically, these are people who are part of the civilian over-16 non-institutional population who are either unemployed or not part of the workforce. According to the April jobs report, the number of jobless American stood at 100.9 million.

That’s an all-time record and it’s an increase of 26.2 million over the last 12 years. It’s as if we absorbed the entire adult population of Canada and not a single person had a job.

The numbers are staggering. The jobs-to-population ratio peaked 12 years ago. If we were to have the same ratio today, we would need 15.3 million more jobs, or 23.7 million fewer people.

(Note: The chart above is the Civilian Over-16 Non-Institutional Population minus the seasonally adjusted Civilian Workforce.)

Phi Beta Iota: As a number, that is almost precisely half the eligible voters in the USA.

Josh Kilbourn: Unemployed College Graduates – Trending Ugly

03 Economy, 07 Other Atrocities, 11 Society, Commerce, Commercial Intelligence, Corruption, General Accountability Office, Government, Office of Management and Budget

The Benefits Of A College Education

ZeroHedge, 05/21/2012

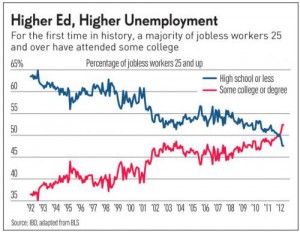

… Are what again? As the following graphic from IBD demonstrates, for the first time in history, a majority of jobless workers over 25 have attended some college, and now outnumber those without a job who simply have a high school diploma or less. But at least those in the fomer category have tens of thousands of non-dischargeable debt to show for it.

.. Are what again? As the following graphic from IBD demonstrates, for the first time in history, a majority of jobless workers over 25 have attended some college, and now outnumber those without a job who simply have a high school diploma or less. But at least those in the fomer category have tens of thousands of non-dischargeable debt to show for it.

Owl: Frack Fluids Can Migrate to Aquifers Within Years

07 Other Atrocities, 12 Water, Civil Society, Commerce, Corruption, Earth Intelligence, General Accountability Office, Government, Idiocy, Office of Management and Budget

New Study Predicts Frack Fluids Can Migrate to Aquifers Within Years

A new study has raised fresh concerns about the safety of gas drilling in the Marcellus Shale, concluding that fracking chemicals injected into the ground could migrate toward drinking water supplies far more quickly than experts have previously predicted.

More than 5,000 wells were drilled in the Marcellus between mid-2009 and mid-2010, according to the study, which was published in the journal Ground Water two weeks ago. Operators inject up to 4 million gallons of fluid, under more than 10,000 pounds of pressure, to drill and frack each well.

Scientists have theorized that impermeable layers of rock would keep the fluid, which contains benzene and other dangerous chemicals, safely locked nearly a mile below water supplies. This view of the earth's underground geology is a cornerstone of the industry's argument that fracking poses minimal threats to the environment.

But the study, using computer modeling, concluded that natural faults and fractures in the Marcellus, exacerbated by the effects of fracking itself, could allow chemicals to reach the surface in as little as “just a few years.”

“Simply put, [the rock layers] are not impermeable,” said the study's author, Tom Myers, an independent hydrogeologist whose clients include the federal government and environmental groups.

“The Marcellus shale is being fracked into a very high permeability,” he said. “Fluids could move from most any injection process.”

See Also:

Reference: Defense and Energy Deficit Reduction: $688 Billion

03 Economy, 04 Inter-State Conflict, 05 Energy, 07 Other Atrocities, 08 Proliferation, 09 Justice, 10 Security, 11 Society, Budgets & Funding, Commercial Intelligence, Corruption, General Accountability Office, Government, Military, Office of Management and Budget, Officers CallPOGO Source Page, May 8, 2012

Wasteful Spending in the Department of Defense Budget

Wasteful Spending on Nuclear Weapons Programs

Service Contracts

Conclusion

Endnotes

Americans are tightening their belts, and it’s time for the U.S. government to do the same. In light of the Budget Control Act of 2011 and the subsequent failure of the “Super Committee,” Congress is still desperately seeking ways to reduce spending. To this end, the Project On Government Oversight and Taxpayers for Common Sense have closely examined the proposed national security budget[1] and found plenty of wasteful spending. Adjusted for inflation, U.S. national security spending is higher than at any point during the Cold War and accounts for more than half of all discretionary spending.[2] However, the U.S. faces no existential threats as it did then, and U.S. defense needs are changing as the military draws down its presence in Iraq and Afghanistan.

Still, military spending at the Department of Defense (DoD) has increased by an astounding 95 percent from FY 2001 to the FY 2013 estimate, adjusted for inflation.[3] Nuclear weapons spending at the Department of Energy (DOE) is projected to grow by billions of dollars over the next decade.[4] And the federal government’s reliance on contractors, most of whom work on national security-related work and cost on average nearly twice as much as the federal workers who do the same job, is also driving budgets through the roof.[5] It’s clear that any serious proposal to shrink the U.S. deficit must include cuts to the national security budget.

The following list updates our recommendations from 2011[6] and details nearly $700 billion in savings over the next ten years, including cuts to wasteful weapons systems as well as limits on out-of-control contract spending. We found programs for which there are cheaper yet equally effective alternatives, and programs that can be cancelled or delayed without putting America’s security at risk.

The Project On Government Oversight is a nonpartisan independent watchdog that champions good government reforms. POGO’s investigations into corruption, misconduct, and conflicts of interest achieve a more effective, accountable, open, and ethical federal government.

Taxpayers for Common Sense is a nonpartisan budget watchdog serving as an independent voice for American taxpayers. Its mission is to achieve a government that spends taxpayer dollars responsibly and operates within its means. TCS works with individuals, policymakers, and the media to increase transparency, expose and eliminate wasteful and corrupt subsidies, earmarks, and corporate welfare, and hold decision makers accountable.

Wasteful Spending in the Department of Defense Budget

Continue reading “Reference: Defense and Energy Deficit Reduction: $688 Billion”